30Oct1:40 pmEST

Draining and Straining This Market Into Halloween

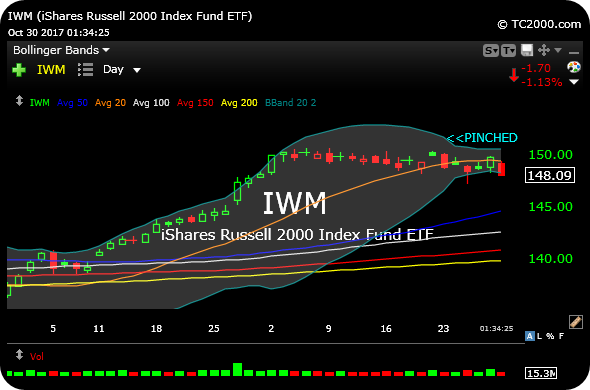

The small market capitalization stocks housed in the Russell 2000 Index continue to lag the senior averages as we head into the heart of today's afternoon session.

On the IWM daily chart, below, which is the ETF for the Russell, we can continue to see those pinched Bollinger Bands we observed last week drive home the idea of a rather compressed market. We do indeed expect directional resolution soon, as the IWM is draining and straining every last ounce out of that compressed pattern.

However, we are also mindful that the market may feature misdirection, with a head-fake in one direction before the real move in the other direction materializes.

Hence, $148 on the dot must likely continue to hold for bulls in order for them to maintain that upside resolution scenario wth a straight face. Thus far today, despite the glaring relative weakness versus the QQQ, $148 has, in fact, held.

But weakness below that level ought to be taken for what it is--A bonafide cautionary sign as a signal to slow down on the long side in the interim, with a few exceptions here and there.

As always, we want to note relative outperfomers on a day like today, which I will do right now for Members in my usual Midday Video.

It's the Same Drill for Unde... Miners: Have You a Valedicti...