13Nov11:04 amEST

GE Needs to Bring Its Chart to Life

For a good while now, one of the more notable dogs of the Dow has been General Electric. GE was a dominant market bellwether at one point, but as life shows us all the only permanence is impermanence. Thus, GE is has become irrelevant on some level, a firm which could have easily gone the way of Lehman Brothers back in 2008 if not for them winning the bailout lottery.

And, technically, the market reflect the irrelevancy.

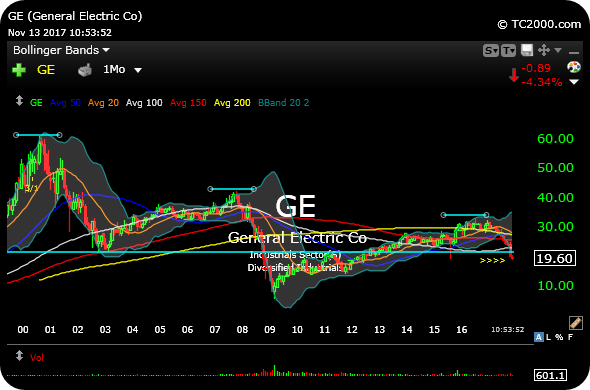

On the monthly chart, below, we have a series of lower highs and lower lows since the turn of the century. That is quite a slap in the face to shareholders, indeed, considering where the Dow is versus where it was even at the peak of the dot-come bubble.

This morning, GE announced it would be cutting its stock dividend in half and selling off some its famous units like railroad and light bulb units which, sadly, renders a commercial like this completely obsolete now. This is only GE's second dividend cut since the Great Depression (!).

However, the monthly chart also shows this current monthly candle is entirely below its lower Bollinger Band, undershooting the prior $21 area (horizontal light blue line). This is a very oversold chart, indeed, on a long-term basis as some awful news flow hits the wires.

But before we give GE's eulogy, let us harken back to former star CEO Jack Welch who believe in the philosophy of selling off businesses which were anything but top or near the top of their respective industries. The pain GE is taking now is rather ugly--It looks, feels, and seems bearish on all levels, though it may be just the medicine the stock needs to finally find a temporary bottom.