30Nov1:48 pmEST

Hunting Season Not So Easy This Year

One of the more interesting aspects of what has been a busy week of market news is that standard short attacks on names like ROKU do not seem to hold as much water as they once did, this one by Citron Research.

I was fortunate to sell a ROKU long on Tuesday morning inside Market Chess Subscription Services before a series of tweets and media appearances sought to expose the stock as allegedly being a "bubble," in and of itself.

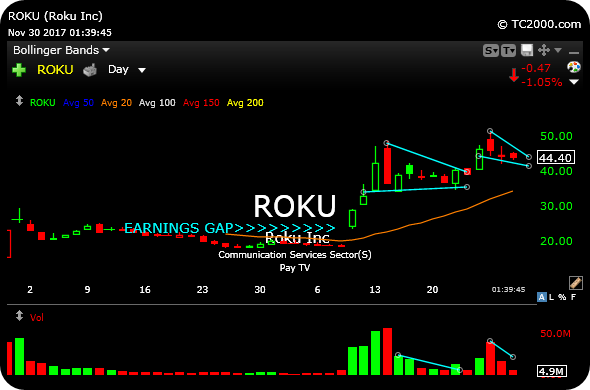

Be that as it may, turning to the actual evidence, below on the daily chart, ROKU has absorbed the latest negative commentary extremely well, compelling me to consider a reentry on the long side.

Note how sell volume has tapered off since Tuesday's reversal, and price never breached the low-$40s, which is an very admirable effort considering how much ground the name has covered to the upside just this month.

Overall, ROKU still has many of the early-stage technical hallmarks of a new growth winner: 1) The heavy and steady surges of buy volume after a bullish breakaway earnings gap higher 2) A "lockout rally" preventing eager longs from getting in so easily 3) Shallow dips after initial shakeouts, and 4) Plenty of doubt about the viability of the name as an actual market winner.

At the moment, I would look for a move back over $46 to get me long ROKU again. But even as the name is red today, it is worth noting how it essentially ignored what could have been an ugly, 30%-esque swoon lower with hunters closing in.

The Greatest Hustler Who Eve... King Dollar Down, But Not De...