09Jan1:43 pmEST

Crossing the Rubicon

With rates moving higher today, perhaps the bond market is finally aligning itself with the implication of the rally in many commodity-related materials plays over the last few months. As is usually the case with markets, things do not always play out in linear fashion.

Moreover, rates on the 10-Year Note, for example, still must climb a good ways higher before we can declare any type of multi-decade change in trend since Paul Volcker fought the back off inflation in the early-1980s.

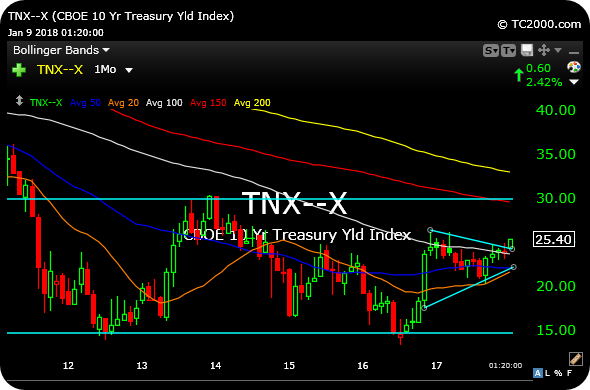

That said, a rough rule of thumb we are using is the TNX-X, or 10-Year Treasury Yield Index, effectively mirroring rates. If we see rates spike back over 3% anytime soon (roughly 30 on the monthly chart, below) it ought to signal that the basing process since the Bernanke years now amounts to a more meaningful bottom in rates and new regime where inflation becomes more a concern than deflation.

The REITs in the IYR ETF and utilities in the XLU ETF already seemed to be a bit concerned, and financials have inversely been celebrating the prospect of higher rates along with materials miners.

Again, it does not always play out in such a linear manner, which means becoming dogmatic that, for example, banks simply must go higher in a new regime could be dangerous.

However, the IYR and XLU weakness ought to be a legitimate concern for longs, since those sectors ignored all of the inflation hawk buzz for years on end.

Bond vigilantes are still a few miles away, at least, from crossing the Rubicon and being able to proclaim any type of victory. As always, though, when we see spikes in rates it compels us to put it into context on a long-term basis--Both the long-term bull but also the prospect of a slow changing of the guard.

High Energy Going for New He... Stock Market Recap 01/09/18 ...