17Jan2:25 pmEST

Let's Drive a Hardcore Pawn Bargain with This Correlation

Oftentimes in writing about markets in real-time, being "too early" versus being flat-out wrong on a given a thesis can often be a matter of semantics and, ironically, not unlike a negotiation at a pawn shop where value is simply determined in the eye of the beholder (who happens to hold some leverage in the negotiation).

In reality, though, "being wrong' is a regular occurrence in trading and especially when writing about markets. As we should know, the critical issue is how effectively we handle being wrong and how readily we can stave off fatal ego and stubbornness.

With this in mind, returning to a correlation we noted last year seems apropos given the recent rally in precious metals and miners, especially those of the gold variety.

As I wrote in a blog post last September,

EZCORP owns pawn shops throughout the U.S. and Mexico. More importantly for us, if you backtest the chart going back over the last few cycles for gold and her miners, you will see a fairly close correlation.

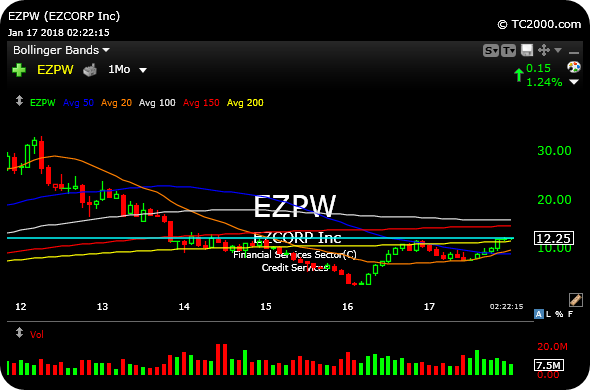

In light of the strength in gold and her miners, the monthly chart for EZPW, below, shows us that the pawn shop conglomerate is threatening a major, not minor, move higher which ought to confirm a significant multi-year bottom. You will also note that overlaying EZPW's monthly with a bevy of gold miner monthly charts aligns properly, enhancing the correlation.

Simply put, theses can take time to develop, especially pertaining to inflection points when it comes to commodities. The issue with gold miners for me was never nailing down the magic timing of the day it they printed their ultimate lows, but rather analyzing the sum of the parts for a broader bottoming process.

As we speak, those parts seem to be coming together to advance the bull thesis for a new leg higher in most commodities in the first half of 2018, including gold and gold miners.