18Jan3:21 pmEST

Big Blue Thawing Out in the Dead of Winter

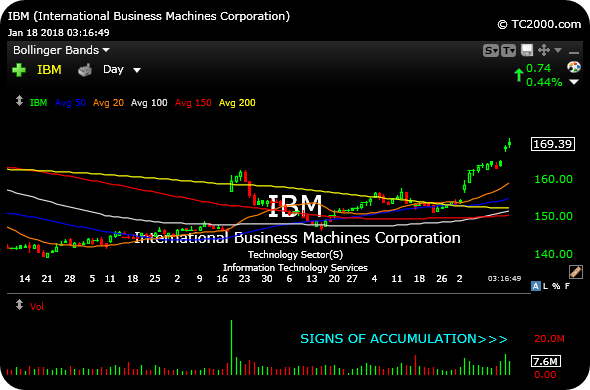

For those following along on our multi-year series about IBM, last year we noted that it was "anyone's game" now as Big Blue had more than hit its multi-year bearish head and shoulders top discussed years ago here.

At that point, it was more of a neutral look and feel to the chart.

However, with IBM's recent price action and volume pattern, impressively below on the daily chart, if Big Blue can avoid an earnings blow-up tonight after the bell we may very well have a more meaningful inflection point on our hands, in favor of bulls of course.

Above all else, IBM will need to continue to operate above its 200-day moving average (yellow line, at $152.40 currently) in order to cement a turnaround.

Elsewhere, a bunch of software tech plays are acting well today in an otherwise slow tape. Frankly, some boring action is not all that bad, as it serves to calm down the nerves of the market after some wild moves in recent sessions.

Lithium: Time to Move on to ... Stock Market Recap 01/18/18 ...