18Jan10:36 amEST

Lithium: Time to Move on to the Next Big Thing

The hot lithium trend (LIT is the ETF, and ALB FMC SQM are the main three lithium/chemical stocks) of the last several quarters is looking rather long in the tooth at this point.

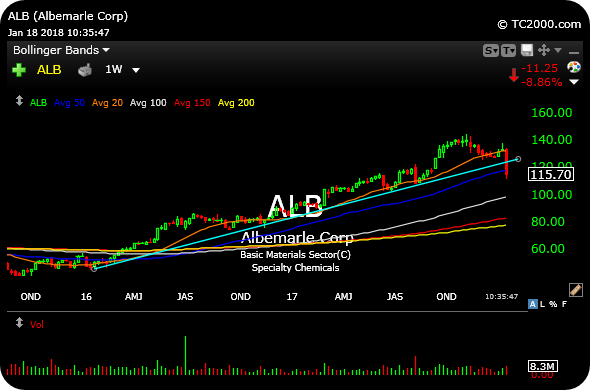

On the ALB weekly chart, below, we have a notable rising steep trend break (light blue line).

Of course, breaking a steep rising support trendline does not guarantee imminent doom for longs, or anything close to it necessarily as we have seen with any dip in equities over the last several years.

However, it does likely point to lithium plays taking more of a backseat for the early part of 2018 in favor of other, more emerging themes.

Without question, though, lithium could easily be in play as a secular bull theme for the next few years, even decades.

But this type of price action in January often sets the tone regarding how big funds are positioned for the first or second quarter of the year. In other words, now would be a good time to let ALB FMC LIT SQM reset, and reevaluate them when the wintry weather breaks.

Elsewhere, some chips like ESIO are off to a hot start in an otherwise mixed market. One of our Members has been rather bullish on ESIO, and it looks like that bull thesis is playing out fantastically if they small cap chip can now hold over $25 into earnings in a few weeks.

Stock Market Recap 01/17/18 ... Big Blue Thawing Out in the ...