13Feb10:50 amEST

The Fox Guarding the Yenhouse

It is often said that during market corrections and times of uncertainty, correlations run more closely together and thus carry more weight. To invert that idea, consider how easy it is to try to call a top during a benign bull run higher based on some negatively diverging correlation or indicator, often to little or no avail.

But when the tide turns, we want to pay even more attention to those correlations for clues.

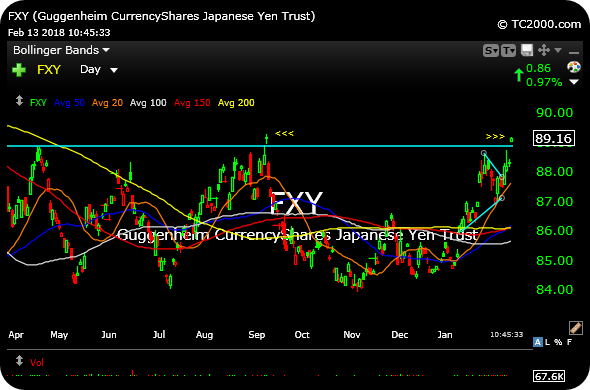

And this morning, we have the traditionally risk-off Japanese Yen breaking to multi-quarter highs, using the FXY ETF daily chart, below, as a rough proxy. Those who follow the Dollar/Yen currency cross will also note the Dollar threatening a major breakdown versus the Yen as we speak.

On the surface, this seems rather bearish for equities. However, bulls are doing a decent job this morning preventing the major indices from rolling back over hard, at least for now.

But what strikes me most is how many individual charts which had been holding up well continue to do so. In other words, bears are still unable to make a dent in the likes of TWTR or even Wayfair (W). And then there are emerging leaders like earnings winner MIME in the cybersecurity complex.

The takeaway from the morning action so far is that bears will need to accomplish more than simply taking down a speculative name like HMNY. Instead, they must quickly pounce on the Yen strength and finally crack the unflappable relative strength names in order to truly get bulls concerned that last week's action was the undercard leading up to the main event, and not the main event itself which is in the rear view mirror.

Stock Market Recap 02/12/18 ... Slow and Steady Wins the Rac...