16Feb1:43 pmEST

Take the Pain

The rally off last Friday's lows has almost been too easy for bulls. But then again, we have seen the "V-shaped rally" phenomenon play out time and time again over a period of years. So, it is tough to really call it a surprise at this point.

Heading into a three-day weekend, with U.S. markets closed Monday for President's Day, I am looking to see whether equities can, simply put, take some expected pain.

There is little argument that some profit-taking is in order after a sharp, snapback rally. However, bulls must avoid the dreaded rollover into the weekend, meaning we would see the S&P 500 Index, for example, end today down 1-2%.

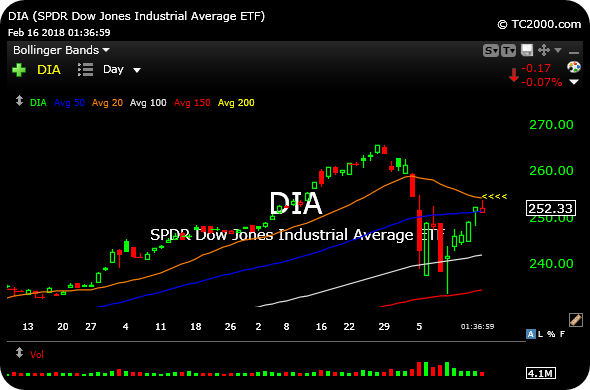

If the indices can take the pain, then a few days of backing and filling on the indices would turn an apparent bearish setup, with the Dow ETF daily chart, below, illustrating (arrows) some fading at its 50-day moving average, into a constructive one.

We also want to see rotation take hold, with energy and materials thriving again. The Trump protectionist talk is helping steels today, with AKS X surging, among others. But energy stocks truly need to stabilize and turn back higher after the last few weeks of giveback.