21Feb10:31 amEST

Assessing the Party Lines

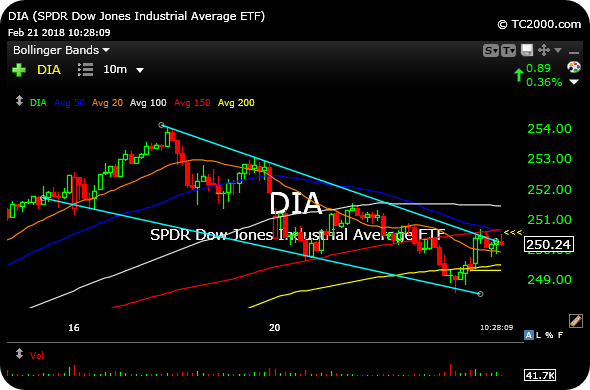

The Dow ETF, below on its 10-minute timeframe, shows us price trying to break up and out of a well-defined channel dating back to last Friday, before the long holiday weekend.

After a sharp relief rally, the Dow has been consolidating ever since, forming this channel consolidation as we await to see if the bulls' party will do its usual job of continuing back to new all-time highs and ignoring any and all warning signs of a corrective market.

In assessing whether this time will be a tad different, we may need to wait for the Fed Minutes later today, as one of our Members astutely noted this morning, since the market is increasingly sensitive these days to anything relating to rates and inflation.

But technically speaking, one gets the sense that if bears cannot pounce on the WMT (and by proxy, the Dow) weakness here, then it may very well be time for bulls to run again with tech stocks outpeforming.

Thus, we want to keep a close eye on the Dow, for if bulls follow-through on this timeframe up and out of this channel it is hard to imagine a scenario where they do not succeed with the entire market, as well.

Stock Market Recap 02/20/18 ... Twitter Technical Analysis f...