05Mar3:36 pmEST

Here's Where Under Armour Needs to Feast After Its Famine

After some high level executive changes, Under Armour's stock is trying to take some notable technical strides after its recent better-than (or not-as-bad-as-expected) quarterly earnings report.

To be sure, there are plenty of sound retail chart from which to choose, such as LULU, if UAA is out of your wheelhouse.

But with Under Armour bears pointing towards the firm falling behind Nike and Adidas, among others, as well as valuation still far from cheap, there may be an opening to exploit the improved technicals, provided that they actually hold and continue to improve.

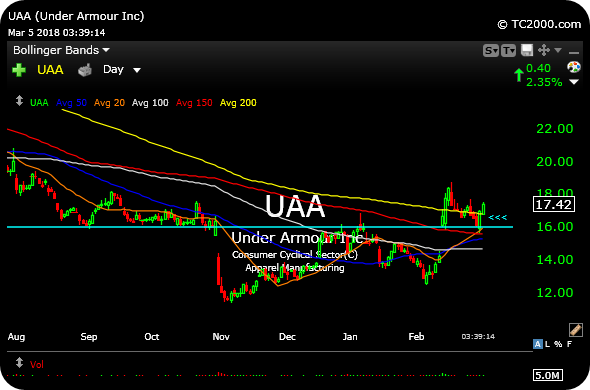

Thus, being bullish UAA may be contrarian from a fundamental perspective, but technically as long as $17 now holds, coinciding with the 200-day simple moving average (yellow line on UAA daily chart, below), a sound case for a swing long can be made trading against that level for a stop-loss.

Recall that UAA fell from an all-time high of $52.94 to a recent low of $11.40. Indeed, plenty of bad news is priced in to that drop. And now bears may be out of position if the stock can build on its recent post-earnings bounce.

Again, UAA is far from the hot growth name it was years ago, when it was lumped in alongside the likes of NFLX as a marquee issue. But after a long famine, one can envision the brand catching up to speed a bit better than it has and the stock responding well given the ferocity of the prior downtrend.

Can You Handle Strong Cocoa? Stock Market Recap 03/05/18 ...