12Mar10:26 amEST

Just Like Old Times for the Semiconductors

Micron is leading the charge higher for the semiconductor stocks housed in the SMH ETF this morning, with MU sprinting higher since dipping under $40 in early-February to a price of $58.65 as I write this.

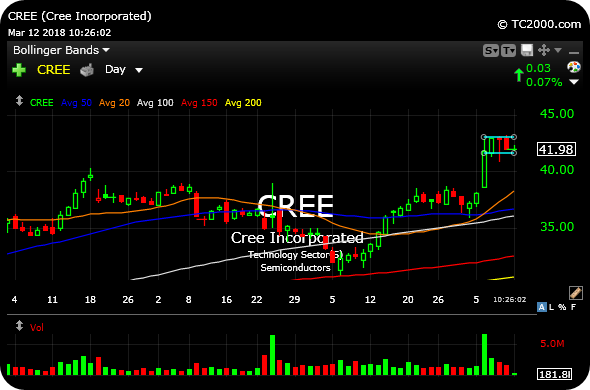

We have played a few chip longs of late in the service, such as CREE (an intriguing long-term turnaround play) and AQ (AI, self-driving software exposure), and are still open to some new ideas. NVIDIA, of course, has been the ringleader for semis for a while now, as that name is perking up at the moment.

But returning to CREE, I am eyeing a re-entry on the long side if this $40 level can hold a high and tight bull flag as support, seen on the daily chart, below.

Cree Incorporated is known for its LED exposure, but actually the bull thesis centers around its "Wolfspeed" unit, which focuses on silicon carbide (SiC) power products and gallium nitride (GaN) radio frequency (RF) devices.

Either way, CREE is much-improved on longer-term timeframes, and if the chips continue to thrive I am looking for another swing long.

A Market So High it Ignores ... A Sippy Cup of Milk to Start...