12Mar1:30 pmEST

Will Archer Bulls Give a Daniels Midland?

The Archer Daniels Midland Company, a Chicago-based $24 billion-plus market cap firm and global food processing and commodities trading powerhouse, is shaping up as a reasonable "tell" as to whether we are indeed in the early stages of a new inflationary bull run for ags and most commodities.

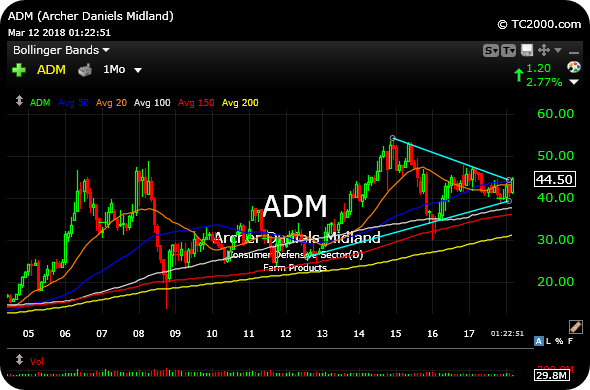

On the ADM monthly chart, below, it is hard not to see the well-defined symmetrical triangle pattern shaping up for years now as soft commodities like corn, wheat, and soybeans all floundered.

Indeed, all of those fits, starts, backing and filling helped to form the triangle, which is why as traders we are constantly challenged to remain mentally tough and recognize that when we see various head-fakes it may ultimately be part of a larger consolidation we must track before an eventual directional break which proves profitable.

Now that soybeans, corn, and wheat have enjoyed a rally the last few weeks, even months, the issue is whether ags are ripe to sustain a bull run like they did in early-2008 (which actually proved to be an inflationary head-fake before a worldwide deflationary crash later that year--Of course it was still a profitable trend to ride during the first part of the year).

Other ag plays like NTR (the AGU/POT merger ticker), MOS, BG, CF, even AGCO CAT DE, are all worth watching to see if they move higher in unison, not to mention lithium/ag/chemical plays like ALB FMC SQM.

However, I view the ADM defined chart setup as well as the prominence of the firm itself as being a focal point. If ADM can break and hold $45 upside in the coming weeks I suspect ag bulls will be well on their way to a having a fun spring.

Chipotle's Chart and Its Pla... Stock Market Recap 04/10/17 ...