15Mar12:43 pmEST

Have Your Guard Up in This Sector

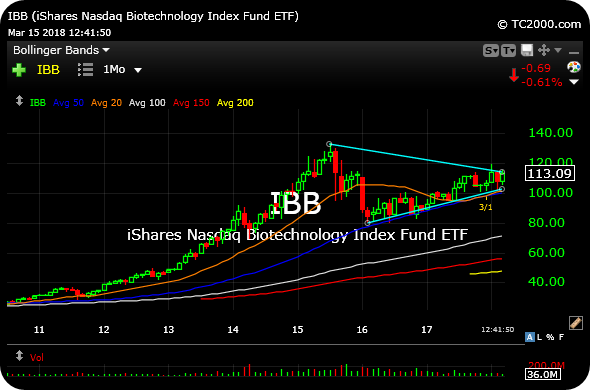

As one of our Members reminded us just now, the large cap biotechnology issues housed in the IBB sector ETF remain at a critical technical juncture.

On the updated IBB monthly chart, this long-term view shows us the initial strength in January to kick off 2018 was insufficient to sustain a fresh breakout for bulls.

Going forward, it sure looks like that $120 level must be adequately conquered in order for bulls to prevail in terms of breaking the massive, symmetrical triangle of lower highs but higher lows since the 2015 biotech peak (highlighted in light blue) higher.

On the downside, I suspect if IBB loses $95 things the selling will intensify and we will look back at the weakness in BIIB CELG REGN in recent months as presaging the breakdown.

Nonetheless, there are quite a few bios holding up and acting reasonably well, as seen in the XBI action, which is the ETF for small and mid-cap biotechs. In fact, XBI is quite clearly outpacing IBB and has been for a while now, be it due to growth appetite by investors or M&A prospects, or both.

Either way, we will must pay attention to this long-term IBB chart for context and perspective of the biotechs headed into the spring months, since price operating at the apex of the massive triangle likely means we see true directional resolution sooner than later, especially after January's initial head-fake.