11Apr10:40 amEST

Hardcore Moves

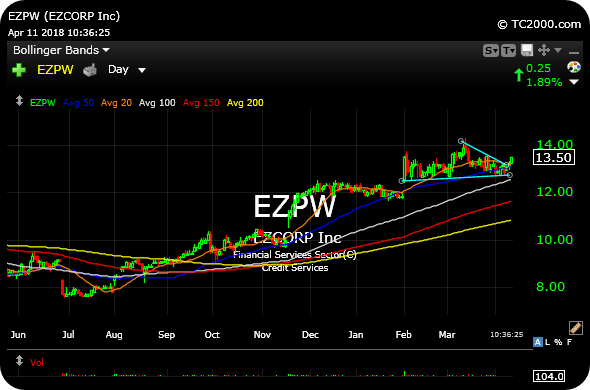

To continue an ongoing series of blog posts regarding a good gold proxy, recall that EZCORP, Inc., updated below on its daily timeframe, previously announced a strategic acquisition of 112 pawn stores in Latin America last October 2017. As we noted, EZCORP owns pawn shops throughout the U.S. and Mexico.

More importantly for us, if you backtest the chart going back over the last few cycles for gold and her miners, you will see a fairly close correlation. Since we last looked at EZPW as gold was basing, so too was EZPW.

Now, however, both gold and EZPW are moving higher, threatening base breakouts on their respective charts. Furthermore, EZPW is obviously related to retail and low-end consumer, another segment which has been performing rather well.

Hence, even if you do not care for the gold relationship, EZPW is a solid setup on its own merits with earnings on May 2nd.

But if you are tracking the correlation with gold, this is exactly what you want to see--The months of base building but not breakdown now threatens to resolve higher.

Also note gold bears have grown noticeably quiet in recent weeks, as the many calls for a new bear market leg lower in gold seem to have been blunted by the fact that, well, GLD is no longer actually in a bear market, with rising 100, 150, and 200-day simple moving averages all lined up smartly and well below spot price.

Regarding EZPW again, breaking and holding over $13.55 now figures to be the next hurdle to sustain a deeper move.