07Jun1:21 pmEST

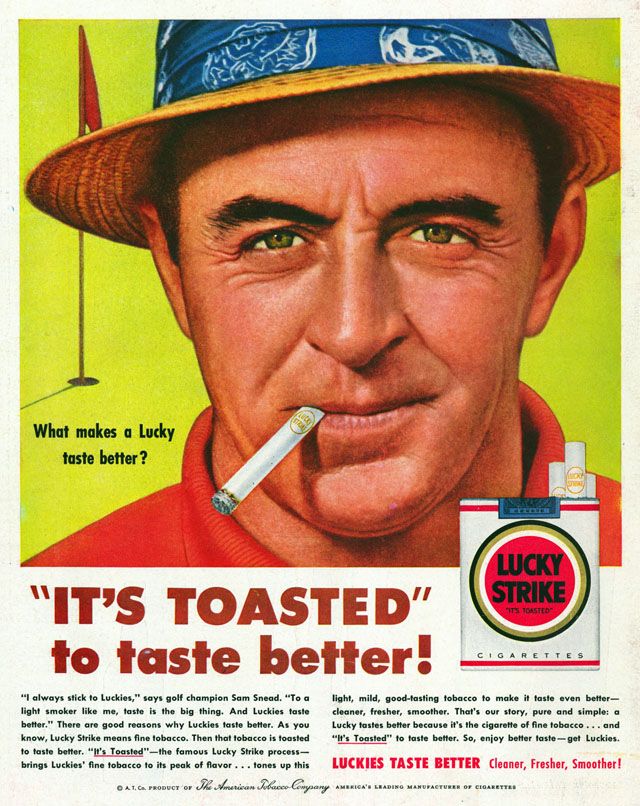

What Makes Tobacco Stocks Taste Better Down Here?

"They are toasted, so they taste better!"

Simply put, plenty of the defensive consumer staples have had an unusually rough go of it over the last few months if not quarters as rates have flirted with multi-year breakouts. We know that defensives tend to fare better in a low rate environment. But the issue is at what point has the market overdone the selling in names like Philip Morris International, among other tobacco stocks like MO (the domestic version of PM, essentially).

in front of earnings in the middle of next month, PM is sporting a bullish RSI (bottom pane) divergence to price on the daily chart, presented below. Price has actually been mired in a downtrend which began around Memorial Day 2017. So, we are talking about a rather well-defined corrective pattern which may be a bit toasted, at least in the interim, to continue lower without some type of meaningful relief rally first.

I am now seriously debating a name like PM for a trade on the long side, despite the fact that I usually do not trade the slow-moving staples, and the despite the fact that PM is not the type of quality chart I usually seek out on the long side for swing trades.

But with tech understandably cooling off today, I tend to favor ideas like these over shorting the tape outright, given the sector rotation threats by bulls and the notion that tech bulls are capable of setting back in quickly into any slight dip.