11Jun10:41 amEST

Another Look at Archer

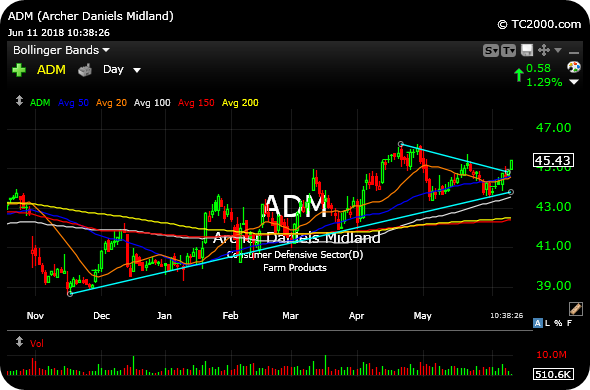

We previously looked at the long-term chart for Archer-Daniels-Midland Company, the global food processing and commodities trading firm, and surmised that ADM may very well be on the cusp of a meaningful breakout from a multi-year consolidation pattern.

Adding credence to that thesis is the recent rotation we have profiled into several XLB ETF holdings, which are mostly firms related to to materials, chemicals, ag sectors. Clearly, ADM fits that bill. And the daily timeframe, below, illustrates the increasing strength with this morning's opening thrust higher.

The $45 level on ADM looks to be an initial area to break and hold above, with $48 as the next significant hurdle above on a multi-year basis. But Archer is making its case among the recent strength in XLB names, and we want to keep a close eye on it here.

Elsewhere, I see Tesla is back over its 200-day moving average, which means shorts must be extremely vigilant as TSLA is notorious for rapid recoveries when it regroups and flips the switch back into bull mode.

Sunday Matinée at Market Ch... One in the Same After a Long...