12Jun3:19 pmEST

Somewhat Dead Ahead of the Fed

While momentum traders seeking intraday hot action are piling into the likes of FIT RH TSLA today, among a few other monster movers like SAGE, the general tone and tenor of the broad market action this afternoon has me thinking the market will slow down and drift into the FOMC event which truly begins after 2pm EST.

Although the beginning of the meeting is already officially underway, this particular June meeting often sets the tone for summer trading in terms of how macro players position themselves in the aftermath of the Fed decision, language, Fed Chair Press Conference, and FOMC Forecasts. And when you factor in a new Fed Chair with his first June meeting now, it likely builds anticipation even more looking out into the back half of the year regarding the Fed's true view on rates and inflation.

With this in mind, we want to avoid over-trading into tomorrow afternoon and leave ourselves some wiggle room to trade the reaction. At the same time, it is not necessary to move to the sidelines in front of the FOMC, given the generally constructive action in the market still seen on most index and sector, not to mention leadership charts.

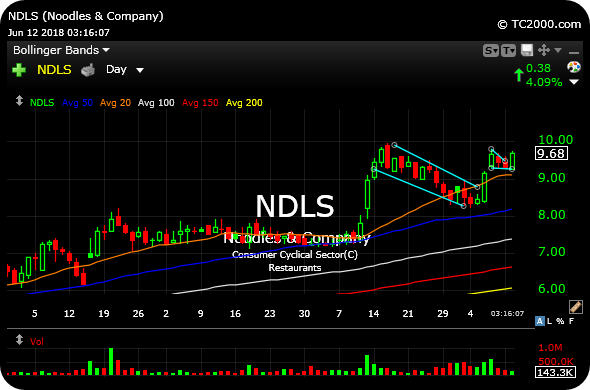

Another idea we are stalking is to keep digging into the restaurant space for hidden gems. Noodles & Company was widely mocked after its IPO and subsequent disastrous price action since 2014.

However, as the daily chart illustrates, below, NDLS is indeed yet another name turning the corner technically and compels us to see if the progress can hold and even sustain itself.