20Jun10:27 amEST

The Starbucks' Bull Run is Out of Orange Mocha Frappuccinos

It seems as though every time a major multinational firm has seen its stock run into some technical trouble over the last several years, especially considering some of the sizable percentage moves these large cap names had enjoyed since 2009 or 2011, the stock sorted through those tough, technical issues with something akin to an orange mocha frappuccino and, just like that, the stock was back in bull mode and making fresh highs, running over bears.

Indeed, calling tops to names like AMZN DIS GOOGL NFLX SBUX V, among others, has been the toughest of games for bears and remains so in most cases. My personal strategy over the years was to pick at those names with quick shorts during broad market pullbacks but not overstay my welcome until any given major technical topping patterns had confirmed, which almost never did--And even when they apparently confirmed, bulls were waiting in the weeds to spring a trap in the form of a false breakdown. Due to agility and discipline, I usually came out with modest wins or small losses on my shorts.

Generally speaking, this bull run dating back to 2013, if not 2009, has featured an awful lot of potential topping patterns rendered null and void and overzealous bears trap themselves on apparent breakdowns while fearless bulls intentionally seek out ugly charts to buy.

At some point, we will see that dynamic come apart at the seams, though it is not likely to happen all at once with individual names.

And that brings us to Starbucks, a topic of recent blog posts here and discussions with Members insofar as the many headwinds SBUX appears to be facing.

Not only is founder Howard Schultz leaving the company not unlike when he did just before the global financial crisis last decade, but the company is facing stiff, increased competition and is suffering from a general brand maturity as the high-priced products and "store culture" (a place to hang out, conduct business meetings/romantic dates/family gatherings), is becoming blasé to many, at best, or worse yet off-putting.

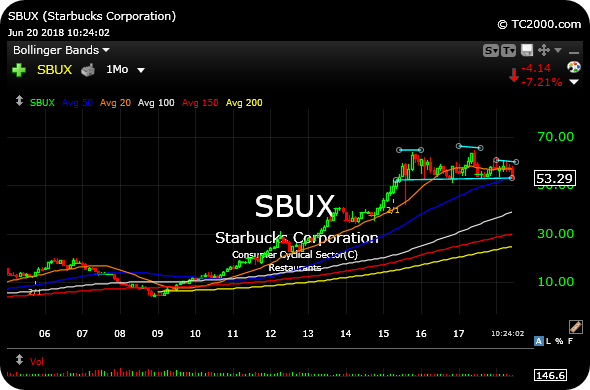

Technically, SBUX seems lined up for another one of those infamous potential top, false breakdown, back to new highs setups bulls have enjoyed. But this time around with respect to Starbucks I am more inclined to lean towards the actual bear thesis. The $50 level on SBUX seems to be the major line in the sand where we will see once and for all if bulls are truly going to defend the big breakdown and potential monster top outlined on the monthly chart, below.

On a brighter note, I favor Dunkin' (DNKN) technically on the long side and generally expect the market caps between DNKN and the much larger SBUX to significantly narrow in the coming quarters.

These Steakhouses Are a Real... Sometimes the Name Just Fits...