03Jul11:04 amEST

Don't Just Stand Still and Look Pretty

The precious metals and miners have a clear trend over the last two-plus years. And that trend would be this: They have been uniquely trend-less.

Indeed, gold bugs and steadfast bears alike have been frustrated intermittently, with head-fakes in both directions and the net result being a whole lot of nothing going in the precious complex. And when you factor in the run-up and harsh corrections, general drama, excitement, and controversies we we have seen in Bitcoin and crypto plays, it makes for a rather dull experience tracking the metals and miners.

However, the long-term picture ought not be lost on the market player, for all of the tedious backing and filling, painful head-fakes in both directions likely amount to a coiled base in preparation for a significant directional explosion once the market decides once and for all what it wants to do with gold & company. I still lean towards upside resolution. But we have been patient with Members in terms of laying off the action for long periods of time in the complex.

Now, though, we have the U.S. Dollar finally slowing down and coming in as both gold and silver bounce from oversold conditions. Most importantly, quite a few precious mining charts have not only withstood recent gold/silver dips, but actually firmed up nicely, which smacks as a bullish divergence.

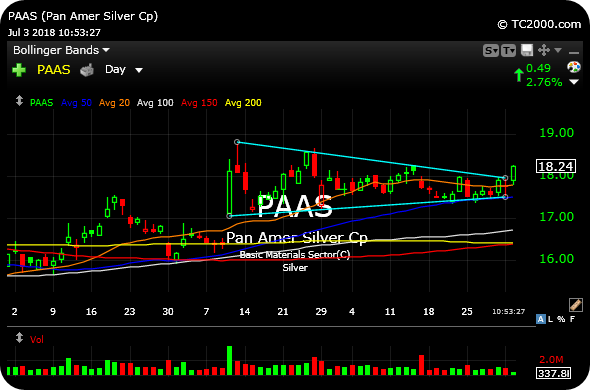

Pan American Silver Company, below on its daily timeframe, is just one of several examples of a high quality long swing trading setup in the precious complex which needs to do more than just stand still and look pretty.

Follow-Up on Monthly Candles... Happy Independence Day from ...