06Jul10:58 amEST

Rays of Light for Biotech Bulls

It is tough to argue with the notion that many large cap biotechnology issues, housed in the IBB ETF, have been a drag on the sector as a whole for a good while now. While it is true that the smaller and mid-cap biotech issues in the XBI ETF have stumbled at various times, especially during the ASCO conference in early-June, the reality is that some of the premier large cap bios have been weighing the space down.

Now, however, we have Biogen (BIIB) surging this morning as peers AMGN GILD REGN all wake up themselves. We have been tracking a basket of some of the standout bios for Members during this biotech malaise, and they most assuredly need to be watched closely for fresh long entries.

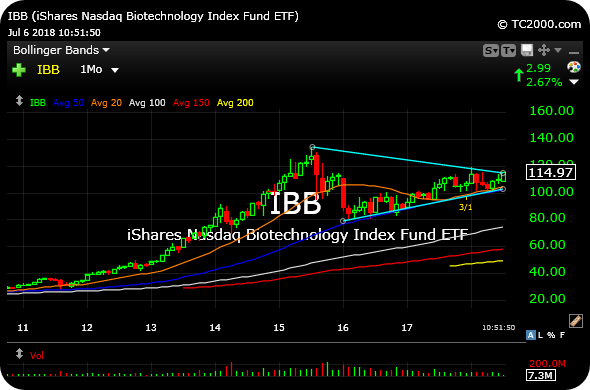

First things first, though, and before we become too aggressive on the long side we want to see the IBB monthly triangle, updated below, resolve higher.

On this site, we previously observed the multi-year IBB triangle consolidation, consisting of lower highs but also higher lows since the 2015 biotech top. This type of consolidation is, in effect, an argument between buyers and sellers taking place, with one side eventually in a position to prevail.

And if biotech bulls can clear $120 upside in the coming weeks, it would clearly give them an impressive upper hand to break the pattern substantially higher, while bears need this chart to break $100 to the downside.

But given the price action this week in many individual bios, along with the XBI right near its own all-time highs, bulls have a golden opportunity to sustain another biotech rotation.

Stock Market Recap 07/05/18 ... Let Me See Your Trade War Fa...