09Jul10:54 amEST

The Coast is Not Fully Clear

Despite a 200 point-plus rally this morning in the Dow, the Nasdaq and small caps are noticeably lagging on a percentage basis. Quite a few tech-related plays flipped red within the first twenty minutes of the session, and TWTR's selloff on the news of the firm deleting 70-million fake accounts is not helping sentiment with respect to upside momentum.

As a result, the Dow's rally seems to be a bit of smoke and mirrors regarding the underlying price action in the tape, at least so far this morning.

On the plus side, banks are catching an impressive rotation. However, they sector kicks off the summer earnings season at the end of this week, spilling over the next few weeks. Hence, the bounce my simply be a bit of short covering before coming onslaught of earnings reports from the likes of BAC C JPM WFC, and company.

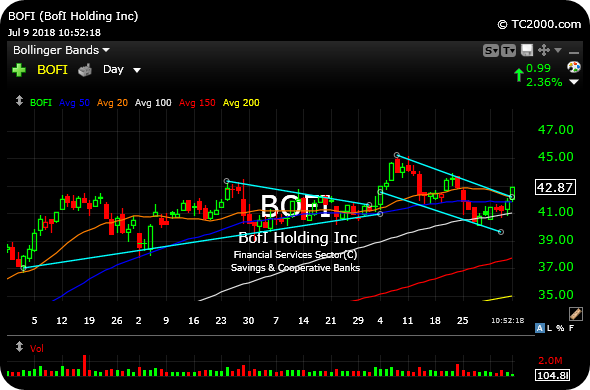

One regional bank chart which has our eye is BOFI, reporting earnings on July 26th. On the daily chart, below, we can see price operating above rising major daily chart moving averages, curling up and out of a tight consolidation.

Regional banks, housed in the KRE ETF, have largely outperformed large cap banks, in the XLF ETF, for most of 2018. And if the financials muster a summer rally, after earnings, I expect the former to continue to outperform the latter with the likes of BOFI leading.