03Aug10:06 amEST

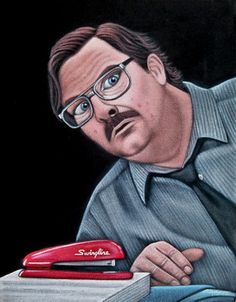

Excuse Me, I Believe You Have My Staples

In light of the constant Trade War headlines with China and this morning's jobs report, the major averages are mostly quiet, either slightly red like the QQQ or trying to hold green like the small caps and the S&P. Some retail names are off to a hot start, and we have a few on the Long Watchlist for Members.

But one part of the market which immediately jumped off the screen this morning seems to be the names in the XLP, ETF for defensive-minded consumer staples.

On the XLP daily chart, below, note price successfully holding above its 200-day moving average after basically operating below it since February. That was kind a steep correction indeed, seemingly under-the-radar for most.

But with an imminent fear of higher rates abating (at least for the summer, that is), some staples are worth stalking for longs, albeit slower-moving ones. We discussed two main tobacco plays a few days ago, MO and PM. And there are a few other enticing XLP names which we want to keep an eye on now if XLP keeps building on this strength above its 200-day.

I recognize these are not sexiest of trading vehicles. However, it is noteworthy that they are just now emerging from a fairly significant correction--One suffered both through time and price.

Volatility Still Sleeps with... Market Forecast: Choppy with...