27Sep3:05 pmEST

LaCroix Might Be Worth LaRisk Again

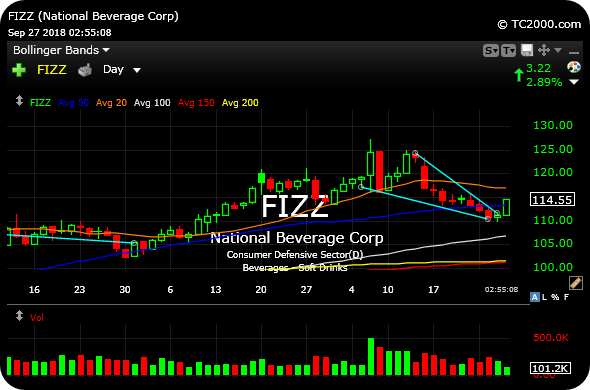

Multiple bullish factors seem to be lining up for longs regarding LaCroix or La Croix, the trendy. sugar free flavored sparkling water distributed by National Beverage Corp (FIZZ), with the parent company's daily chart updated below for you.

First and foremost, an announcement regarding cannibas infused LaCroix can come at any time now in the current market climate, which ought to given the plethora of short sellers (as a high percentage of the stock's float) pause. And there is always risk of a larger beverage player making a buyout offer in hopes of procuring a strong, popular brand with even a cult-like following.

Of course, that may not happen. But the chart is offering an intriguing risk/reward setup for longs after an orderly pullback in recent sessions.

FIZZ is cutting back over its 50-day simple moving average (dark blue line) as I write this, and could easily send shorts scrambling not only into the end of this quarter but also into the holidays.

The overarching trend remains firmly higher, and I have seen little evidence that shorts have waved anything remotely resembling a white flag, which means either they know something we do not or, more likely, they are making something akin to a financial suicide pact with their respective theses regarding the bear case for FIZZ. Naturally, the market vehemently disagrees with them, and has for a good while.

I am long the name with Members with a protective stop-loss below $107.

Elsewhere, tech is doing a better job overall today shaking off relative underperformance again from the small caps. I am curious to see if that lasts into the bell, as we saw a poor close yesterday.