23Oct10:29 amEST

Sink or Swim Mentality for a Sink or Swim Market

"sink or swim" - to fail or succeed entirely by one's own efforts

Speaking from experience, corrective markets often magnify the flaws in many traders' strategies and discipline (or lack thereof). Indeed, downtrending markets are unforgiving and, at times, ruthless in their aggressive price discovery mechanisms in terms of running traders out of business in a hurry. Options traders, for example, quickly see once-beloved call options expire worthless week after week, even month after month, after enjoying seemingly effortless profits during the smooth days of the uptrend.

It is precisely during these types of markets, however, that we must summon our inner strength to take full accountability for all of our acts and omissions as speculators in lieu of passing the buck to the latest headline which supposedly spawned the selloff.

As the Dow is currently off by nearly 500 points and the Nasdaq lower by 2.5% or so, we must guard against brazen trades in the hopes of chasing back any losses quickly. We must also allow the correction to run its course, for however long that may be.

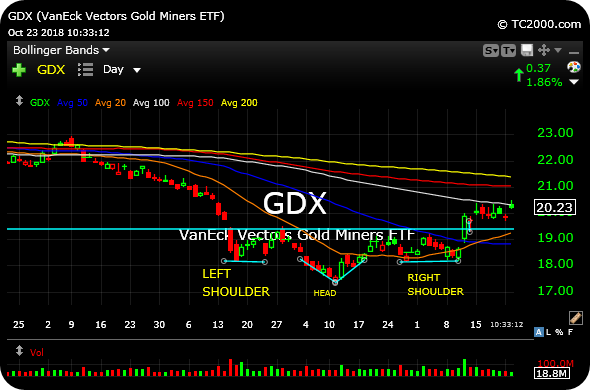

Turning to a more actionable idea, precious metals and their miners are catching that safety bid this morning. The GDX ETF for gold miners, updated below on its daily timeframe, is still sporting an impressively confirmed inverse head and shoulders bottom. I am looking for a move at least up to the $21.50 area before reevaluating. Also note many gold miners report earnings in the next few weeks.

That said, it is a promising development to see the complex rebound from yesterday's disappointing price action in the face of this morning's selloff in the broad market.