02Nov10:56 amEST

Not Marriage Material

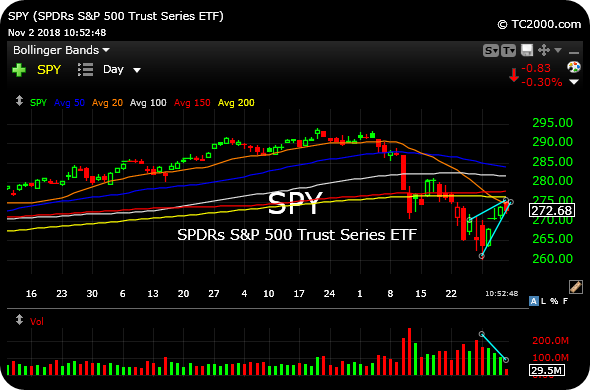

As one of our Members astutely noted earlier, the S&P 500 Index's ETF, SPY, basically tested its 200-day moving average from underneath in the pre-market surge this morning. Whether or not that will suffice to render the current relief rally near its termination date remains to be seen. However, what we do know is that it remains tough to trust a market where bounces appear to be cheered on far more than selloffs figure to be respected or feared.

In other words, the biggest risk to this market is that you ain't seen nothing yet. And the October correction was simply setting the table for another spike in volatility amid further technical deterioration.

Apple's post-earnings selloff was initially brushed aside by the broad market in lieu of the cheer from the jobs number and developments with President Trump and trade diplomacy. Nonetheless, we would be foolhardy to cavalierly dismiss such a monstrosity of a market cap and brand getting hit in such a ferocious manner the likes of which it has not experienced in a good while.

As a result, for better or worse I elected to move to a full cash position this morning in my trading account. Headed into the weekend this market seems to be setting more traps than a local bookie setting betting lines before the Super Bowl.

Mind you, I would have personally loved to have become more aggressive on the long side today if the action called for it and if meaningful improvements were made on the indices. A few dates, then eventually marriage via swing longs for two months into the end of the year. But facts are stubborn things, to paraphrase John Adams, and the SPY is in grave danger now of printing another lower high by price vis-à-vis the mid-October lower high, seen on the daily chart, below.

All of this is happening below a declining 200-day moving average, a very serious technical condition to be respected, which means if you think I am overreacting and being too cautious then my response would be simply be, "You, first."