09Nov10:32 amEST

Southwestern Tough to Survive This Saloon

Crude oil bulls have found themselves in the wrong saloon, and have yet to alleviate the situation in any way, shape, or form. Just this morning, for example, we have another gap down not just in crude itself, but also the OIH XLE XOP ETFs for energy-related stocks.

Oil has been noticeably weakening since early-October, perhaps coinciding with the market's weakness too at various junctures, though surely detaching at times as equities rallied where crude did not.

However, the gaps lower in OIH XLE XOP look to be bear flag breakdowns on their daily charts, with bulls needing a last-minute reprieve to stave off a fresh leg down.

While the crude weakness persists, however, natural gas is gapping higher, once again, to little fanfare. The Long UNG/Short USO pair trade seems to be playing out, with the long-term natty bear market likely rendering most market players and pundits skeptical of virtually any rally. Still, the UNG chart is pristine and only strengthening.

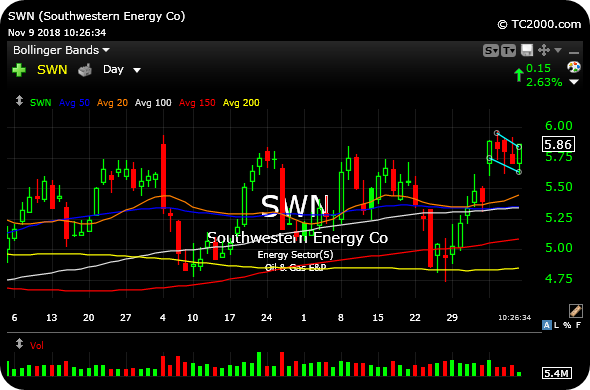

As a result, you will note select energy stocks like Southwestern, below on its daily chart, seem to be responding much more to the UNG strength than the USO weakness. This is the epitome of relative strength in a tough sector, at the moment. But if USO can find some type relief soon, perhaps the entire sector can bounce with the natty-related names acting like newfound leadership.

Is Tesla the Leader We Shoul... Weekend Overview and Analysi...