30Nov10:39 amEST

Apple, Goldman, Oil Continue the Heel Turn

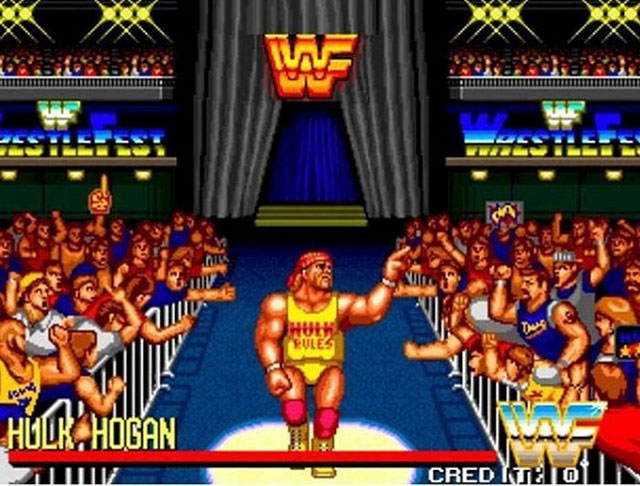

"Turning heel" means that a player is shifting from a "face" persona to a "heel" persona, or turning from a "good guy" to a "bad guy."

One of the most famous examples of someone "turning heel" is probably when Hulk Hogan was reintroduced as "Hollywood Hogan" and joined the New World Order.

Shares of Apple, Goldman Sachs, and the price of crude oil are all dropping as I write this, as the three of them have all been a thorn in the side of the bull case for "risk on" for a while now. In particular, last week's bloody Thanksgiving series of trading sessions featured persistent weakness from AAPL GS USO (the last ticker being the ETF for crude) substantially outweighing any attempt at a holiday rally.

Nonetheless, this morning we have an interesting development insofar as the indices not only hanging tough despite the AAPL GS USO slide, but actually pushing session highs as I write this. True, the PANW SPLK WDAY earnings rallies are helping the cause.

But to rally in the face of AAPL GS USO weakness into the weekend would have to be considered a bull victory given how easy it would be for traders to flatten out and sell longs with all of the potential headlines which could emerge over the weekend, G-20 or not.

One group which continues to defy general sector weakness of late has been the emerging retail leaders like DECK GOOS UAA, all green here and sporting strong charts.

As long as the broad market does not succumb to the "hell turn" of AAPL GS USO, my main focus is on identifying up-and-coming leaders which could be the new batch of big winners going forward.