09Jan10:54 amEST

FOMO Fatigue for a Drowsy Market

Another early pop off the opening bell looks to be fading as I write this. And this time around I am less emboldened by the prospect of buyers immediately swooping back in. As a result, I lightened up on a few of my quick-hitting swings longs inside Market Chess Subscription Services, and am inclined to let any pauses or pullbacks play out a bit first before jumping back in with a new batch of trades.

While it is certainly true that the potential for a further "FOMO" (an acronym standing for Fear of Missing Out) rally is a distinct possibility, we must continually catch ourselves insofar as not turning a blind eye to the sloppy technical backdrop of all of the major indices in light of a rough fourth quarter of 2018. Indeed, that may take some more time to heal than we expect, even with some promising, emerging new leadership in the software space, for example.

One area I am turning my focus to, once again, is the gold mining space. After a few days of fairly constructive digestion, I see the GDX ETF is reacting positively to another U.S. Dollar selloff.

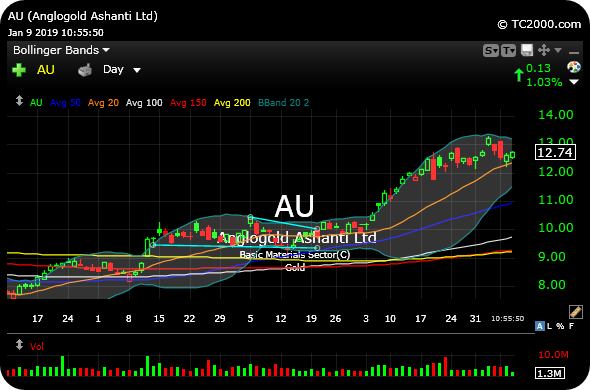

There are a few directions to go in, depending your risk tolerance and timeframe. But Ashanti, below on its daily chart, has held up as well as any of the larger gold miners and continue to sport a sound chart.

Stock Market Recap 01/08/19 ... A Bit Too Much Tap-Dancing f...