10Jan10:56 amEST

A Pedestrian Roll Down the Valley

Bears were almost assuredly looking for a more violent pullback this morning, as the price action thus far smacks more of digestion after an epic feast in the form of a sharp relief rally since Christmas.

At the moment, the major averages are still comfortably holding above their respective 20-day simple moving averages with little in the way of aggressive selling. In order for us to see anything resembling a new leg down in this correction, I suspect we will need to see signs of the trap door closing shut on newfound longs. Instead, this is simply a pedestrian stroll downhill. That can change quickly, of course.

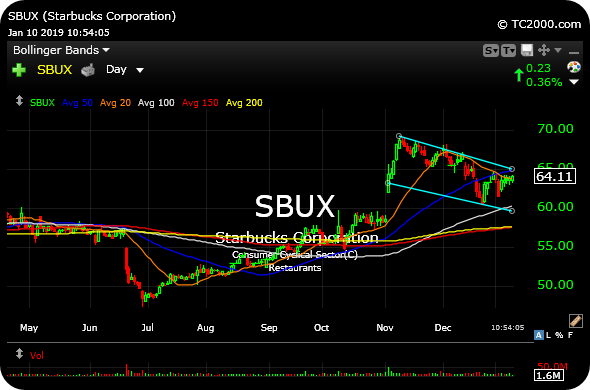

But as long as this dip stays shallow, my focus is on observing which names continue to act well on a relative and absolute basis. One of our Members flagged Starbucks this morning, for example, which has experienced virtually no technical damage since the broad market correction began last autumn, as seen on the updated daily chart, below.

SBUX fits neatly into the basket of select food/restaurant-related plays acting brilliantly of late, including CMG and WING.

I also still have eye on the gold miners as they continue to act well, overall. The GDX ETF still needs to clear $21.55 for me to think a fresh breakout is imminent, though.