22Apr2:53 pmEST

Dark But Familiar Days for Biotech

This is why we look at charts--Not for our crystal ball predictions, nor for the voodoo of the craft. Instead, we observe charts to help manage and define our risk as serious speculators trading real money.

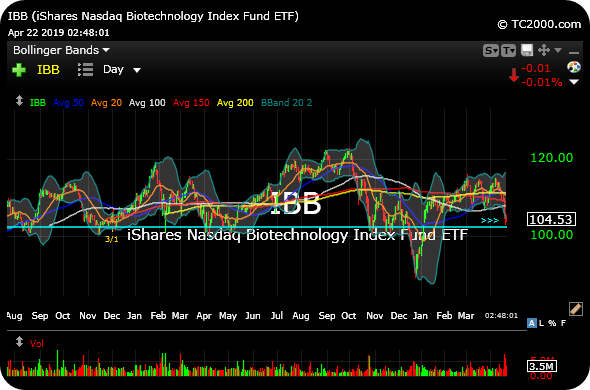

On the zoomed-out daily chart for IBB, ETF for large cap biotechnology stocks, note how significant the current price level is. Note only is price oversold, short-term, after punching below the lower Bollinger Band last Thursday. But the $101-$104 area served as prior support dating back to the summer of 2017, at least (and actually was a big level as far back as 2015, too).

Hence, these are dark but familiar days for biotechs, not just large cap but the small caps in the XBI, too. And even with some "FANG" names flexing today, like NFLX, in front of AMZN earnings this week, among others, it is hard to see the market comfortably moving higher anytime soon without the bios at least stabilizing at current levels.

And that is why we look at charts, if nothing else.

It's Gonna Take Patience and... Stock Market Recap 04/22/19 ...