02May10:49 amEST

Watered-Down Market

There is a colorable argument to be made that this market may very well be best served with a broad-scale, multi-day selloff which helps to reset many strong but extended charts in tech. Even the most steadfast bulls could appreciate such a scenario, which may come to fruition yet.

But on the back of some harsh earnings downside reversals yesterday, namely in TWLO, bears are not quite seizing any short-term initiative yet this morning. In fact, with growth names like SQ and YETI both dumping hard after their own earnings, combined with weak crude oil action, one would think a follow-through day lower would be a no-brainer which, again, still may happen yet.

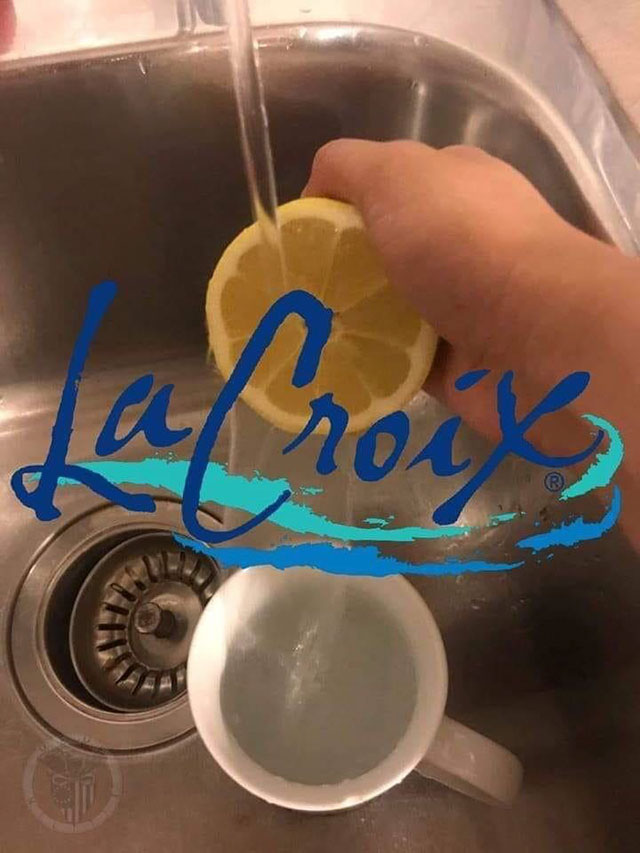

At the moment, though, the small cap and Nasdaq outperformance are keeping things afloat, yielding a fairly watered-down market feel to the action. As we work through the rest of the session before more earnings tonight and a big jobs number tomorrow morning, you can be sure bulls are resting their hopes on stabilizing any short-term weakness in the IWM and QQQ.

Separately, given the multi-week rally in the large cap banks housed in the XLF ETF, I still have my eye on Goldman to lay catch-up to peers like BAC C JPM MS.

On the GS daily chart, updated below, note the flag underneath its 200-day moving average. Banks do not seem to be giving up the ghost in light of the Fed not turning overly-dovish. A push over $208 or so would have my interest on the long side, going forward.

Stock Market Recap 05/01/19 ... Beyond Meat: Ingredients for...