06May10:47 amEST

Time to Call it for the Summer, Right?

The temptation my very well be to cash in one's chips on the long side today and prepare for seemingly inevitable market volatility this summer, especially in light of the China/U.S. trade war tensions taking a very serious turn yesterday. Moreover, U.S./Iran tensions are not helping the cause either, in terms of adding yet another point of concern for the bull case for a smooth trend higher.

Although the above case is entirely logical for a "sell in May and go away (coming back around Halloween)" scenario, we ought to at least see if bears can inflict damage beyond an overnight futures session full of sensational headlines and commentary.

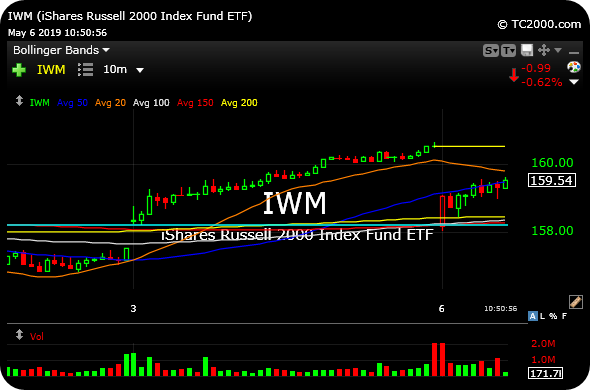

As I write this, for example, the important small caps in the IWM (a part of the market we have focused on more than usual for a variety of reasons all discussed previously here and with Members) are slightly outperforming the larger indices.

In addition, as you can see on the IWM 10-minute chart, below, the small caps did not even come close to a gap-fill dating back to Friday's gap higher.

All things considered, it is tough to embrace the case for a major regime change in the market if bears cannot at least overturn most or all of the small cap progress late-last week. In fact, bulls are threatening to re-take the $159.50 breakout level right now.

To be clear, I am not trying to paint a perma-bull or rose-colored glasses scenario for markets. Those of you who have followed my work over the years likely know that if the market takes a turn for the worse, beyond a bad Sunday night, I will take my lumps, cut losses, and move to full cash or put on some shorts.

But seeing a software name like MDB up nearly 1% here while small caps cannot even fill a gap from last session is not the recipe bears are looking for early on to set the tone for an ugly summer.

In other words, I am not prepared to cut ties with longs, head to the beach and call it a summer, just yet.