27Jun10:53 amEST

Back Up to the Surface

Despite weakness in shares of Boeing (BA) weighing on the Dow Jones Industrial Average this morning, small caps in the IWM and tech as a group are soundly outperforming. Indeed if most bulls had their druthers I presume they would assuredly choose IWM QQQ strength virtually any day of the week in lieu of the Dow, on account of the higher beta growth stocks housed in IWM QQQ.

With the 4th of July holiday one week away and the clock winding down on second quarter of trading, it would not surprise me if volumes taper off considerably until the end of next week. But what interests me most is whether quarter-end profit-taking may have already run its course.

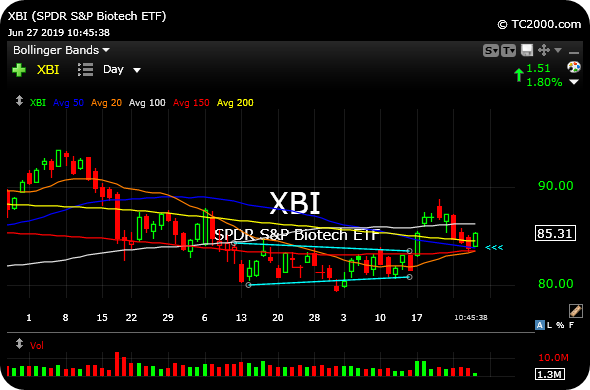

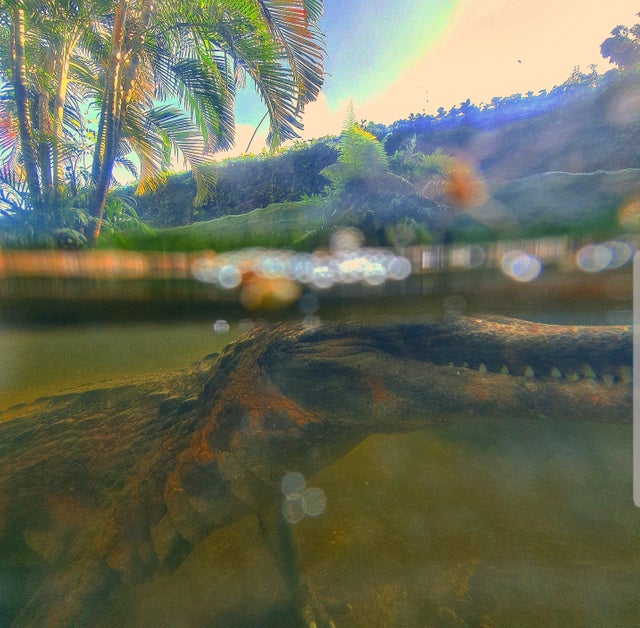

Case in point: We have the XBI, ETF for smaller cap biotechnology issues, rallying back above its 200-day simple moving average (yellow line on daily chart, updated below), coming back up to the surface after being dunked underwater over the last several sessions. Considering the weakness yesterday in healthcare and bios at-large, this snapback strength is particularly promising. Of course, the strength needs to hold for more than a good morning.

But with some standout individual bios like ARNA exuding excellent relative strength all spring and early-summer when there was seemingly every chance in the world to sell off harshly, I am open to increasing biotech exposure into July.