05Aug2:34 pmEST

This Market Requires Beer Goggles

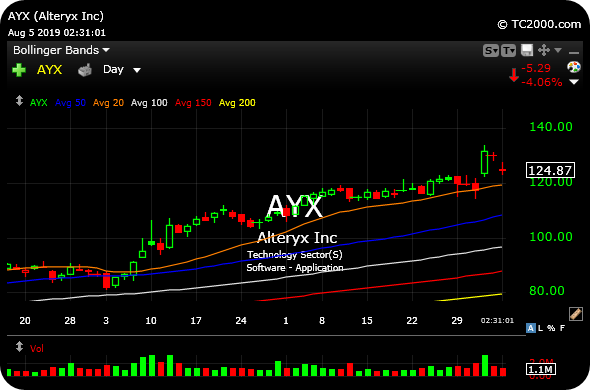

In the midst of an 800 point Dow selloff, seeing a software growth leader like Alteryx, Inc. (AYX) down by a mere 4% may seem about par for the course.

However, when we view the updated AYX daily chart, we will note there is no damage of which to speak...yet. Furthermore, AYX is not yet putting in any type of large, solid red candle which would denote heavy duty selfing and several damage to the uptrend.

In fact, AYX is still above all rising moving averages. Naturally, that can change quickly if this broad market selloff gathers steam. And I am not in a rush to add back long exposure, just yet.

But there is always a silver lining. And on a day like today we may need to put our "beer goggles" on to find attractive longs. Of course, when we are simply observing relative outperfomers instead of hitting them with size in the hopes they can defy corrective action in an August market, it is much easier to appreciate more subtle signs of relative strength.

In other words, AYX is one of several software growth names I am watching during this selloff to see if it can keep avoiding a total washout which requires time to heal. We have seen just that already with a bunch of other names. So, that would make AYX all the more attractive headed into autumn if, and it is a big if, it can simply fight through a more standard pullback in lieu of sloppy, disorderly selling days.