09Aug10:38 amEST

Averting Danger

As much as we could talk all morning about specific price levels on the indices for bulls to hold into this giveback we are seeing from yesterday's rally, such as 2,900 on the S&P 500, the reality is that we likely do not see stocks bounce again until and unless bond bulls ease up.

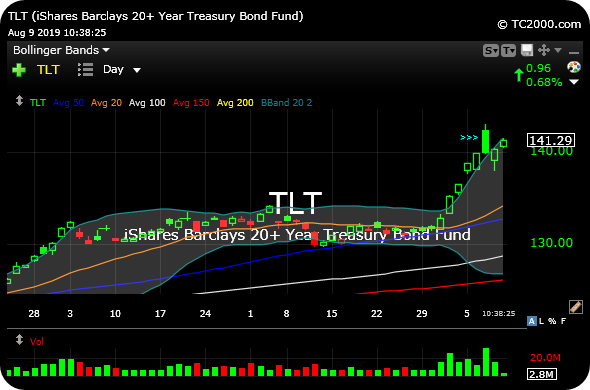

Specifically, TLT is back at it again, with nary a red daily candle in sight the last two weeks, as seen on the updated daily timeframe, below. That will need to change soon if equity bulls want to sustain a relief rally for more than a day or two at a time, in all likelihood, as the rush into Treasuries of late seems to smack of genuine fear regarding the global economy and various trade war headlines, to boot.

Granted, I may be over-simplifying the market structure. But it would still behoove equity bulls to try to take bonds down any way they can today. At the moment, all of the major indices are holding above yesterday's lows. On the surface, that is a promising sign if that stays true throughout the session into the weekend.

However, I suspect all of us keeping one eye on TLT will be a theme if bulls are to avert danger.

I've Got My Toes in the Wate... Weekend Overview and Analysi...