10Oct11:02 amEST

A Good Show at PNC

Wild overnight action is giving way to a relatively smooth cash open this morning for bulls. At one point last evening, as news hit of China planning on leaving early with no trade deal in place, it seemed like we could have some type of variation the limit-down BREXIT or 2016 General Election drama we saw in the futures back then.

Instead, things calmed down rather quickly. And now we are looking to see whether the major averages can keep making incremental progress in what is still a decidedly choppy tape. As an example, QQQ holding over $188 for the duration of the session would be another minor win for bulls, albeit with the looming possibility of further headlines crossing the tape at a moment's notice.

Beyond China, though, we have rates reversing back higher. This development looks to have slowed down the precious metals and miners, although that sector is far from damaged. Simply put, as we noted for Members into the bell yesterday when I sold out of my AG long, we want to given the precious metals/miners a few days to try to absorb higher rates now before stepping back in.

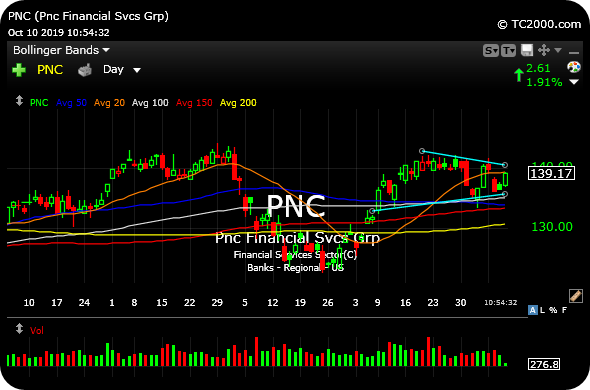

On the plus side, higher rates is benefiting the banks, as goes the old Wall Street logic. The well-known names like BAC C GS JPM MS WFC are all nicely higher as I write this. But PNC may be one of the better charts in the XLF sector ETF.

On the PNC daily chart, below, note the cup and recently-formed "handle"in recent weeks. PNC is above is 50 and 200-day moving averages and figures to be in play for a long-term breakout above $145 is higher rates become a developing theme and banks benefit from rotation.

We're All Just One Trade Dea... The Energy/Materials Bear Ma...