16Oct10:52 amEST

A Nap; Just Not a Dirt Nap

Software growth names are back in the doghouse this morning, be it due to a NOW downgrade or simply sellers reasserting themselves in the likes of AYX COUP MDB RNG SPLK WDAY, among others.

Clearly, when we see these growth stocks come back under pressure it gives us pause regarding the potential for an imminent move to new highs in the broad market, complete with healthy, broad-based participation which makes for more enjoyable swing trading.

However, there are a few positives worth noting this morning based on the action so far.

First and foremost, note how the small caps in the IWM are green and offsetting the Nasdaq weakness. In fact, IWM is peeking its head just above the key $152 level as we speak. Simply put, we must monitor this test rather closely as $152 represents the confluence of some serious technical points which we have been noting for Members.

Beyond that, the lowly sectors like biotech, energy, and materials are also outperforming tech and not being pummeled like they would have over the summer or in September with a shaky market. This is exactly the type of relative strength and newfound resilience you would like to see for downtrodden sectors to prove they are, in fact, bottoming. Some recent M&A in the biotech space does not hurt the cause, either.

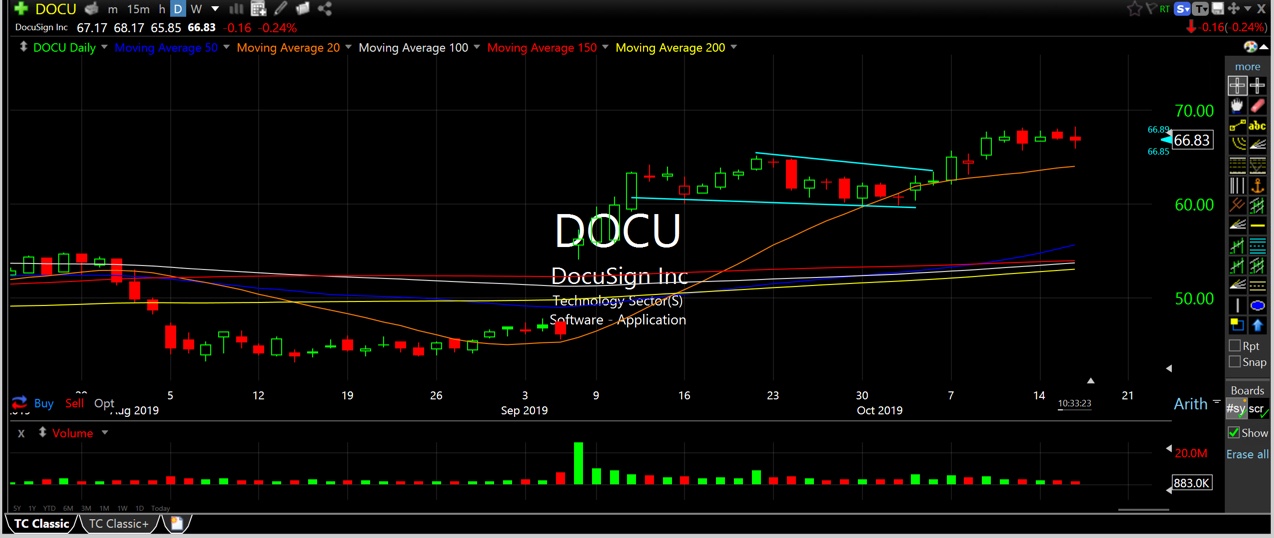

Circling back to software, my horse in the race of late has been DocuSign, a name I like long-term, too. On the DOCU daily chart, below, as long as we see the sort of relative and absolute strength we have out of the name, I will try to keep holding while trading around part of the position. DOCU is acting like a true, emerging sector leader in software and that is worth reiterating with its performance on both down and up days. Taking a nap is fine, even on up days for a name which has been as strong as DOCU--It just needs to avoid some of the scary, monstrous gaps lower like FSCT that software has suffered.

Finally, Netflix earnings tonight could be a Nasdaq-mover. NFLX had a bad summer but you get the sense a fair amount of lowered expectations was priced in during the swoon from nearly $400 down to roughly $250 in just a few weeks this summer.