04Nov1:49 pmEST

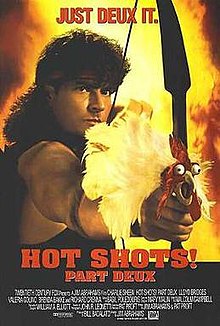

Long Live the Commodities Bear Market, Part Deux

More good news for the working thesis that the energy complex has put in a long-term bear market bottom: Natural gas is confirming an intermediate-term inverse head and shoulders bottoming formation, seen below on the UNG ETF daily chart, with a strong gap up above its 200-day simple moving average (yellow line) today.

True, natty is enjoying a seasonal tailwind, as the market begins to discount the cold winter months ahead.

However, you are talking about lengthy and vicious bear markets for most natty-related stocks, be it CHK CNX or SWN, among many, many others. Take a look at those long-term charts and you will realize that the only bad news not priced into those stocks at this point is full-blown bankruptcy. And while that may be a viable risk yet, when the commodities themselves begin to act better and capital rotates back into the sector, you get the feeling that bears missed the golden chance to go for the kill.

Going forward, beyond the mega cap leaders like XOM improving like it is today, we simply want to see more consistent and heavy buying in the OIH XLE XOP ETFs for energy stocks that we are seeing today. While that may seem obvious, remember that the first leg higher in a new bull market often features the market playing "hard to get" in terms of letting patient longs in too easily.

Thus, the next few weeks should see, according to the old Wall Street playbook, runaway type of short squeeze action fused with heavy, organic buyers.

Special Edition: Full-Length... Time to Zig When They Should...