08Jan3:35 pmEST

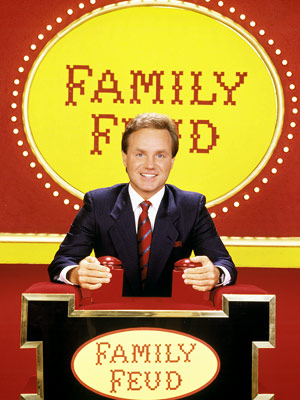

Survey Says...

There seems to be much more than meets the eye with SVMK, doing business as SurveyMonkey, which is an online survey development cloud-based software as a service company.

Since its 2018 IPO, as you can see on the zoomed-out daily chart, below, SVMK has knocked out a large range in the teens but, mostly, has fallen into the shadows amid the various software and general tech rallies we have seen ever since. A series of bounces up to the $18/$19 area has been promising over the last few quartets but, ultimately SVMK was not quite ready to move.

A look below the hood of the car, though, reveals a few compelling points about the bull case going forward. First and foremost, SVMK has ties to some major firms, namely FB which has a stake in it, as well as a CRM partnership. Beyond that, some major players in the hedge fund world own stakes in SVMK.

Moreover, Zander Lurie has done an admirable job as CEO since taking over after the prior CEO, Dave Goldberg, suddenly died.

Technically, SVMK seems poised to finally clear resistance this time around as the sector is heating up around it. A buyout is always possible in a bull market for a hot sector like software, too, and especially given the firm's connections.

Above all else, SVMK has been the type of business model which is too easily mocked as being just another Silicon Valley gimmick of an enterprise. But when prominent players like FB and CRM are involved, I tend to think they see the value here and there may very well be a nice opportunity as software stocks enjoy a resurgence.