24Feb11:04 amEST

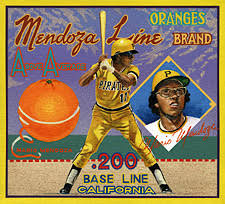

Back Above the Mendoza Line

The CBOE Market Volatility Index, or VIX, which is considered to measure "fear" according to the options market, is shooting higher today after flashing signs of life last week for the first time in a good while.

Back over 20 now, the VIX is crossing the "Mendoza Line," so to speak, where it begins to take on some significance of typically a corrective market in equities. Baseball fans know the Mendoza Line as a phrase referring to a given player's poor batting average of .200. Hovering around the Mendoza Line will most likely keep a player off of a roster, or at least a starting lineup.

For our purposes, the 20 on the VIX should be viewed as a Mendoza Line for bulls in equities, meaning if the VIX holds over 20 then it becomes likely bulls begin to lose their grip on what has been a strong uptrend.

While you may be thinking bulls have already lost that grip, what with the Down down roughly 1,000 points at session lows today, note that we still have plenty of growth stocks above rising 50-day moving averages as the QQQ (ETF for the Nasdaq) battling its own rising 50-day m.a. as we speak.

But the real test should come as to whether the VIX can effectively hold over 20 now, and build on the notion of a stocks correcting further. As you can see with prior spikes in the VIX on the updated daily chart, below, moves above 20 tend to be short-lived and, ultimately, lead to new rallies in equities as volatility comes back down into the teens.

Will it be different this time? Bulls are pointing to standouts like GILD KDMN SDGR ZM, among other green names. Some fear to shake out longs in wild names like SPCE seems reasonable. So I am not yet in the camp that we are on the cusp of a major change in trend beyond a few sessions of shaking the tree.

Stock Market Recap 02/20/20 ... Stay Enterprising During Tim...