16Mar12:38 pmEST

Too Early to Start Nibbling

Although I would love to be more sanguine regarding the seemingly ubiquitous notion that the current trajectory of a nationwide lockdown will quickly abate in a few weeks and a lead to a surge in pent-up demand, which in turn will yield the mother of all "V" shaped rallies, I suspect the shock of quickly slipping into a recession, if not worse, will take some time to sort itself out. At a minimum, let us at least allow the businesses which only now acquiesced to pressures to actually close their doors a few days first, namely bars across the country and casinos in Las Vegas and Atlantic City. The longer they took to close down, the more cases assuredly spread throughout their corridors, including to their employees who were simply following orders and placing trust in their employers.

As for the market itself, another circuit breaker seconds into the opening bell gave way to at least a modicum of normalcy as the rest of this morning has been spent grinding up and sideways on the indices with individual plays catching attention of traders.

Specifically, "virus beneficiary" plays like APRN CLX GRUB PTON ZM faring well, while virus "losers" like MGM PLAY are getting hit particularly hard, among others.

A move back under $108 on IWM as we speak is putting pressure on early dip-buyers, however.

So it is time to start nibbling for the long-term?

I am in the "no" camp for now, as I believe we did indeed enter a shock recession this month which could be much deeper than many expect if consumer and business behavior undergoes a metamorphosis in light of this generational event.

Our country on lockdown with curfews is something which would qualify in the short-term as worse than the Great Depression from the standpoint of its impact on GDP, without being overly-dramatic. To expect a V-shaped recovery seems foolhardy and misses the mark in terms of the psychological effects the next month or two is bound to have on the American psyche.

Simply put, I will pay more down the road if need be when I know more.

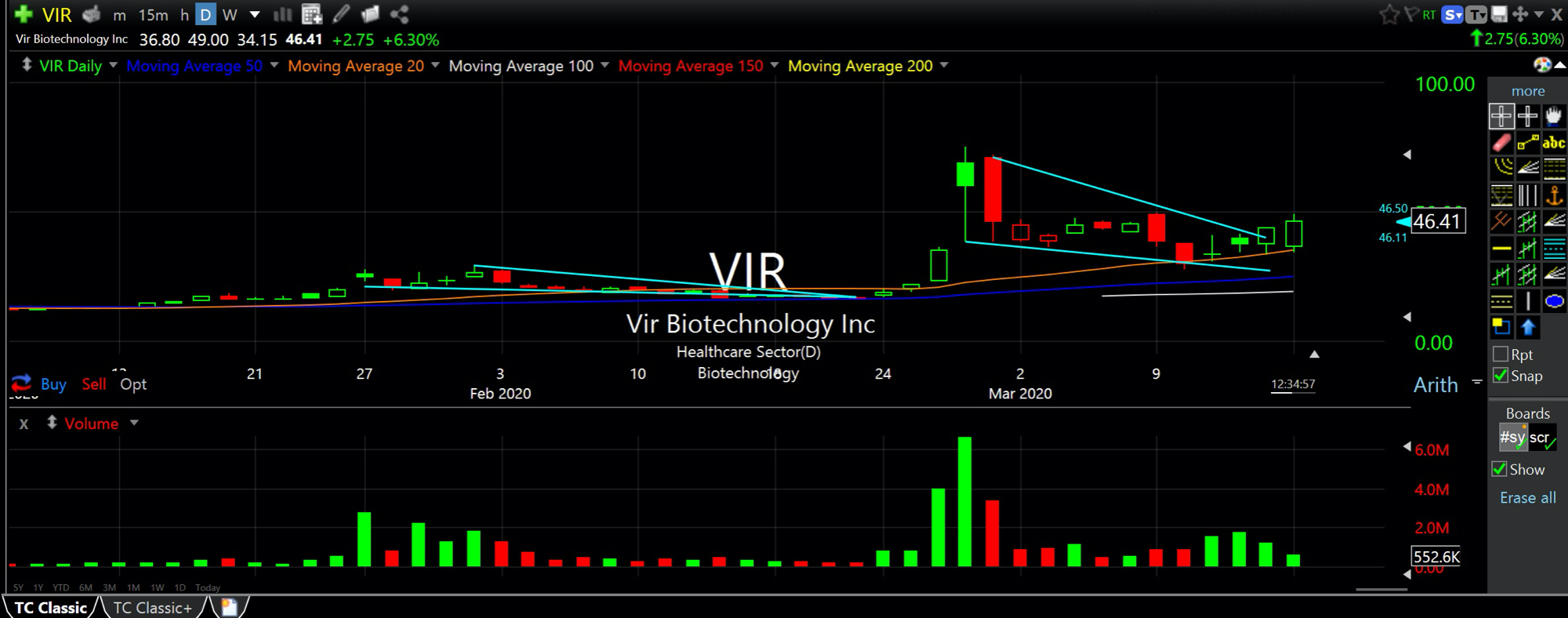

As for intraday trades, the virus vaccine play VIR looks impressive on its daily chart, below, a the firm has ties to BIIB and the Gates Foundation.

Sunday Night Bonus Video 03/... Stock Market Recap 03/16/20 ...