23Apr11:52 amEST

From Down-and-Out to Overhead Concerns

While crude oil was going negative earlier this week we noted the many energy stocks which simply looked tired of going down. Titans like CVX and XOM in the XLE ETF were grinding sideways in lieu of crashing, while the high beta names like exploration XOP ETF were even more surprising, as many of them were actually shooting higher. CHK was halted today due to a surge higher after the dreaded reverse-split just last week, for example.

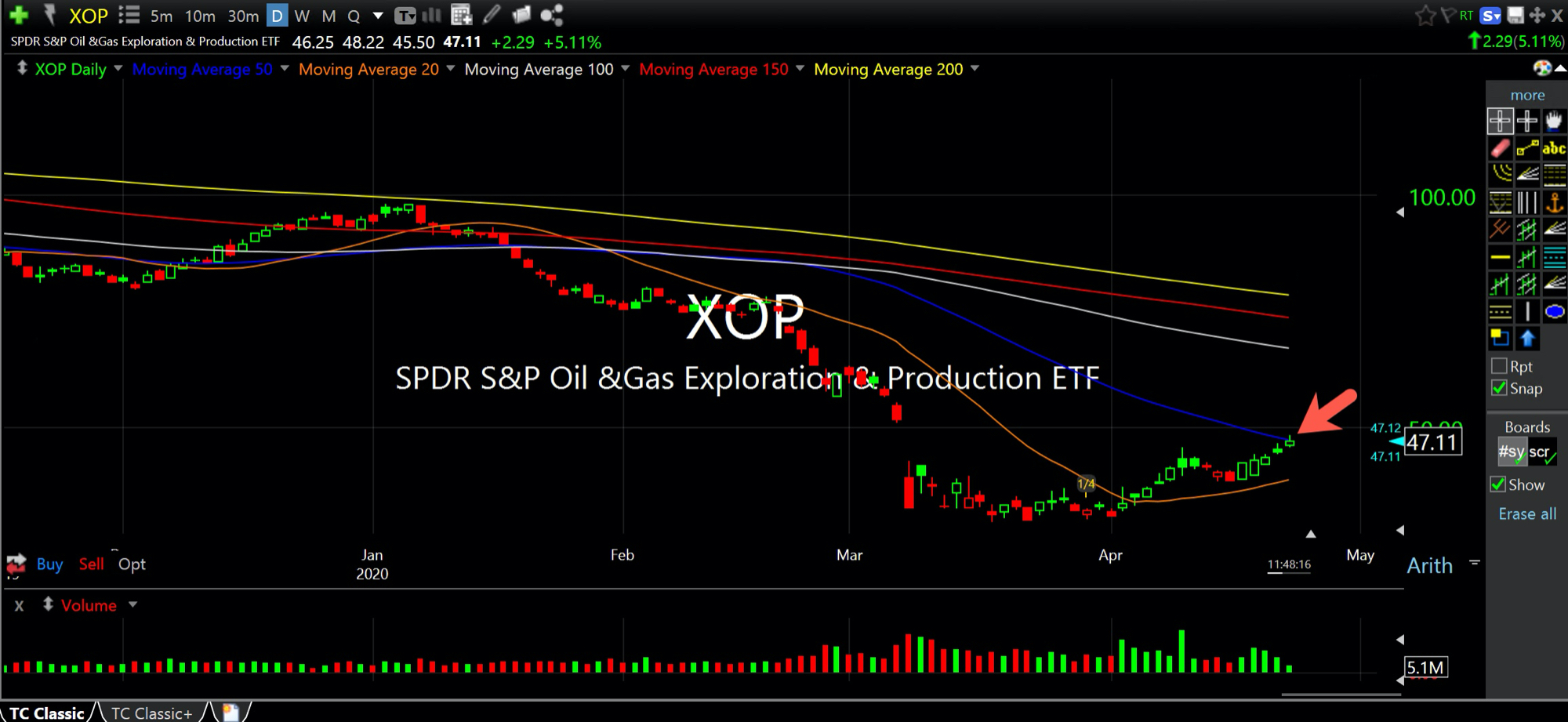

The interesting point now is that the XOP is suddenly at potential resistance, seen as the declining 50-day moving average (dark blue line and arrow, below). This would mark the first test and a sudden one at that, for bulls into the energy bounce.

COG, by the way, is a potential new leader if energy has, in fact, bottomed, exuding excellent relative strength for the last few months.

As for the market at-large, the morning squeeze is tapering off a bit. I am looking for bears to try to make a stand into the afternoon in order to prevent another post-Jobless Claims rally, something which has been the norm over the last month or so and which continues to be a very bad look for Wall Street to the casual market observer at home.

Let's Get Ready to Reap from... Stock Market Recap 04/23/20 ...