01May12:41 pmEST

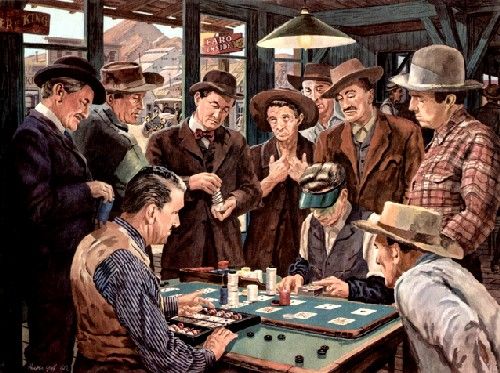

Who Wants to Try to Hustle the Hustler?

Warren Buffett will be speaking to the world on Saturday, May 2nd, at Berkshire Hathaway’s 2020 Annual Shareholder Meeting.

Due to the pandemic, the meeting with be virtual but there will be a Q&A portion, usual. Greg Abel, Berkshire’s vice chairman of non-insurance operations, will be taking previously submitted questions with Buffett. Abel will take the place of Charlie Munger this time, as Abel is assumed to be next in line to take over Berkshire when the time comes.

Now, as far as gaming what Buffett is likely to say and his general attitude towards the market/economy here, it is highly likely that he will be long-term bullish as usual. Buffett is a famous long-term bull on America and has a few hundred years of history to prove it, provided that your timeframe is long enough and you are invested in great companies.

While many remember Buffett writing a famous "buy the blood and buy a slice of America" Op/Ed he wrote back during the October 2008 crash (the market officially bottomed in March 2009 but many individual stocks bottomed that autumn), people forget that Buffett was much more cautious about the economy and market earlier in 2008. Even though he was still splashing in the railroad space as recently as 2007 (relative to the 2008 collapse, that is), he had the wherewithal to acknowledge in early and even mid-2008 (pre-Lehman) that valuations were not yet wildly attractive.

So, the notion that Buffett is a perma-bull by definition at all times is not true (see this interview from 1962, too).

Recently, we know Berkshire reduced its stake in major airlines, and left the door open to sell out of them altogether. We do not have much information yet whether Buffett bought stocks over the last month or so, as he has been unusually tight-lipped and has stayed away from financial news television interviews.

My sense, if I had to try to game Buffett for this meeting, is that he will still be long-term optimistic and even try to cheer up a great many people as he knows just how mentally draining this pandemic/lockdown has been beyond the actual virus damage, itself. Buffett always has his legacy, image, and reputation in mind, whether he admits it or not, and being the patriarchal voice of reason for long-term optimism makes sense now.

But he will also likely disappoint bulls with some of his comments--Berkshire reducing the airline stake is not a mere trading move, or anything close to it. I suspect Buffett sees major headwinds for the next 18-36 months for most travel, hospitality, and restaurant plays, among others.

Simply put, bulls are hoping for an October 2008-style Buffett bullish declaration about stocks, but my sense is they will get the early-2008 version of him gently implying we have more turbulence ahead first.

As for the stock itself, BRK, the A-shares, below, reminds me of many other large cap names here on the weekly chart--Bear flagging after a 30% rally or so off the March carnage and now in danger of rolling back over.

Gold and the Miners: Let 'em... Warning: New Paradigm Coming