02May5:42 pmEST

Warning: New Paradigm Coming

The selloff in equities to close out last week saw renewed jitters about the formidable month of May in markets, in general, combined with the persistence of the pandemic and lockdowns.

The problem areas for this market over the last few months sold off hard again and are far from healed charts, be it cruise lines like CCL NCLH RCL down 10-14% each, casinos LVS MGM WYNN down 5-10%, and major airlines AAL DAL LUV UAL down 5-10% each, too.

Furthermore, as we surmised in a blog post on this website late-last week, Warren Buffett is out today with plenty of long-term, rah-rah American patriotism about our country and markets even as his near-term actions and outlook are far less bullish.

Interestingly, all of these swirling headlines mask a few tidbits about the market to close out last week which seemed to be overlooked: Both gold and the Invesco DB Agriculture Fund (DBA) turned in green sessions on Friday. In and of itself, that may not blow you away.

However, if we are in fact seeing renewed fears of this historically deflationary demand shock it is quite noteworthy that gold and her miners gathered themselves nicely into the weekend after spending the better part of last week correcting some overbought chart patterns.

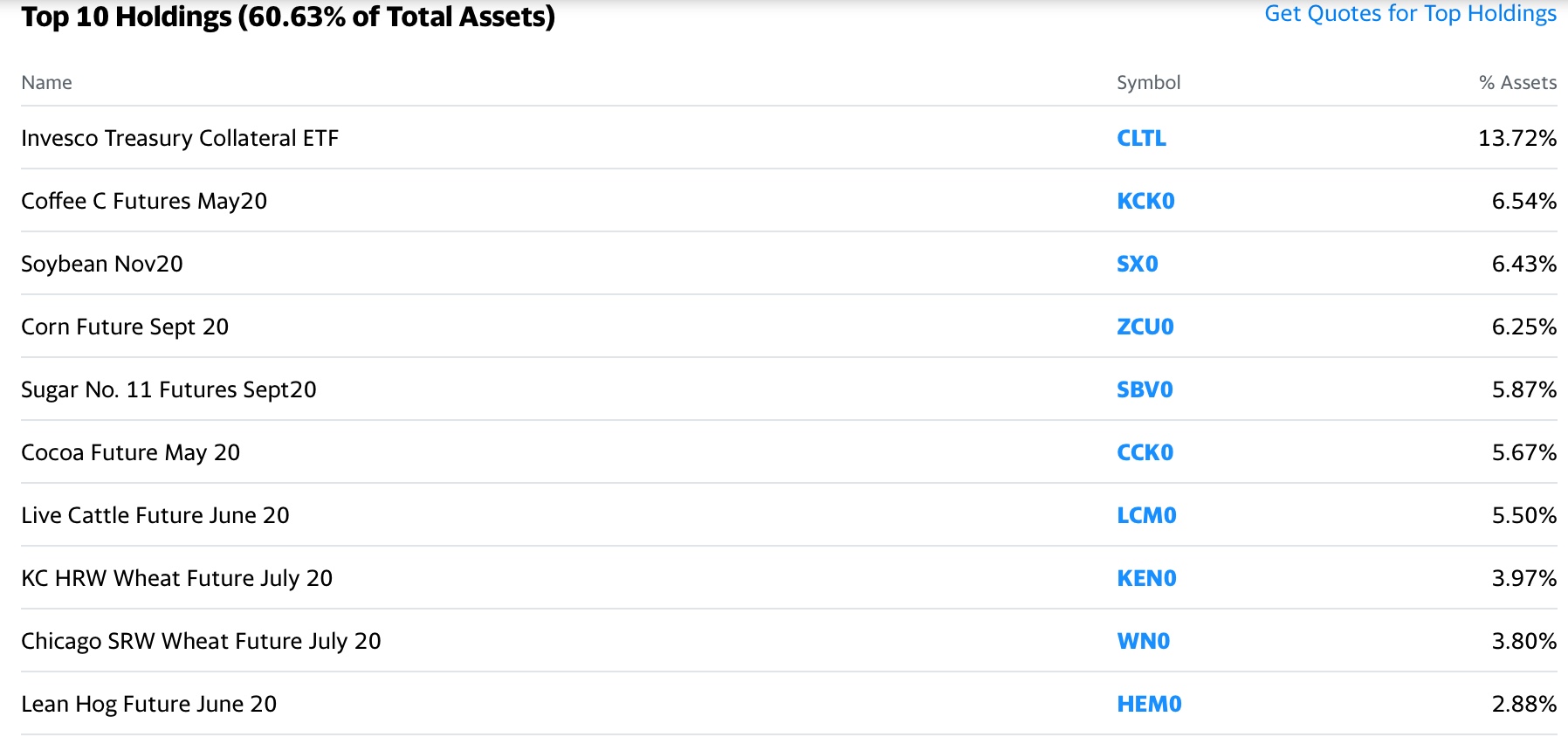

As for DBA, first, here are the holdings of the Fund, courtesy of Yahoo Finance:

Next, that DBA daily chart, below, shows an upside breakout from the highlighted falling channel. If you zoom out the chart to a multi-year look, you will be amazed at just how weak these commodities have been over the last decade. Hence, any whiff of supply disruptions coupled with inflation expectations should send most of these "soft" commodities rocketing higher.

Surely, supply disruptions with respect to pork and meat could be helping the Fund.

But that gets to the very essence of the type of cycle we are currently negotiating: Surging unemployment with lingering lockdowns likely to shutter more mom and pop businesses throughout this month, especially as programs like the PPP continue to flounder and consumers are reticent to dive back in to restaurants, bars, clubs, etc. head-first.

Beyond that, The Fed's historically aggressive interventions alongside the government's attempt at Stimulus has many looking for inflation, especially with food prices adding insult to injury to consumers.

But what of the deflationary shock and fallout from the lockdown and pandemic at-large?

Just as "Stagflation" of the 1970s saw rising oil prices (and wages, due to the comparative strength of labor unions back then) mix with tepid economic growth to create a palpable malaise for Americans, we may very well be in the midst of a similar cycle, except soft commodities and not oil see the "shock."

The other scenario which has been garnering popularity among some fund managers and macro thinkers has been one of hyperinflation, where the Dollar quickly loses value and confidence in the entire system fails. That may be on the table, but with the greenback still the world's reserve currency I suspect we are still at least a few chapters away from that horrifying point in the novel. But gold and softs can thrive in both the inflation and hyperinflation scenarios (two out of three ain't bad).

For now, the main point is to resist dogmatic themes about comparing the current cycle to, say, 2008, where deflation was the only game in town in the back end of that year, spilling over into the first part of 2009--Recall that the oil price spike and rally in commodities overall (See: FCX chart, for example) in early-2008 merely set the stage for a larger deflationary crash in the fall with Lehman, as the head-fake in inflation was simply unable to persist.

We should only be so lucky this time around.

Who Wants to Try to Hustle t... Weekend Overview and Analysi...