26Jun10:47 amEST

We Were Oh-So-Close

One of the silver linings of the mass protests which included, at times, chaos and anarchy, in American cities across the country was that maybe, just maybe, the worst of the Coronavirus pandemic was behind us as we saw the social unrest dominate headlines over the last several weeks in lieu of the previous nightly stream of death counts and hospitalizations.

However, over the last week or so the virus has come back with a vengeance and is now inflicting a ton of pain in states which initially seemed like they had avoided the worst of it from March through May. Large, populated, and economically very significant states like Florida and Texas are dealing with surges in positive virus cases as Texas re-locks parts of its economy this morning.

Thus, the pertinent issue for us is whether the market has accounted for such a scenario of big states going back into lockdown or at least going backwards compared to what the market has been expecting with its resilient rally since the March lows. On some level, if Texas and Florida completely go into lockdown mode now one would have to consider that another exogenous event along the lines of what we saw in late-February/early-March.

And the fact that it is happening now in early summer is all the more concerning given that the heat and humidity was supposed to be a virus-killer. As we know, both Texas and Florida are uniquely hot and humid this time of year. Then again, with people opting to stay inside in air-conditioning, that may serve as the catalyst for the virus to spread more easily.

Either way, equities are a bit rattled this morning but also not crashing through the floorboards either like they were in March. The QQQ ETF is below $242 as I write this, a level we have been watching keenly this week both here and with Members. If bulls fail to recapture it into the weekend then I am looking for more weakness next week leading up to Independence Day and beyond.

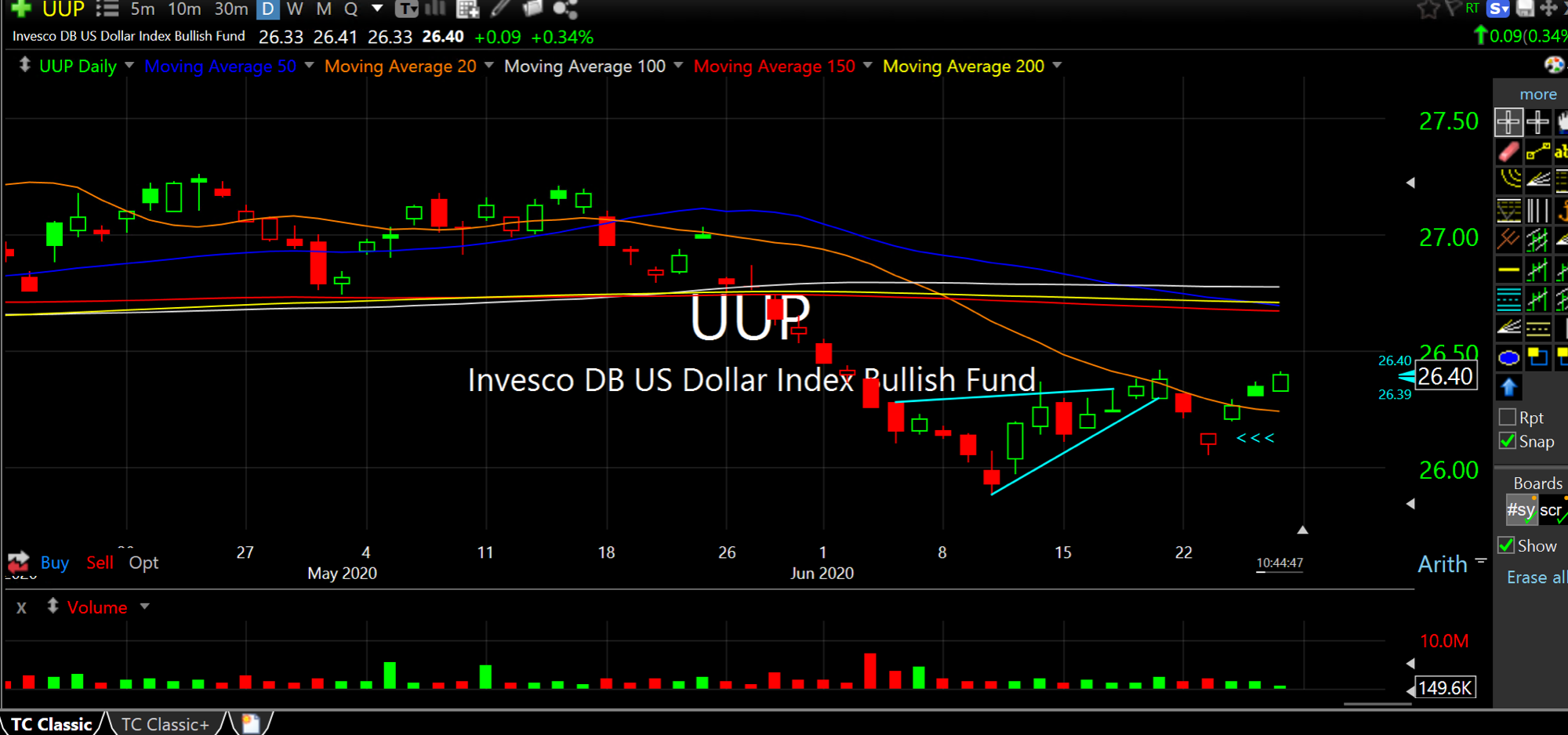

Another factor which seems to be overlooked: The U.S. Dollar had a perfect chance to truly break down with vigor this week. Instead, as we see below on the UUP ETF, the greenback stopped on a dime and reversed higher for a potential false breakdown. As a result, earlier this week I sold out of gold and miner positions and adopted a straight-up short bias.

We know a surging Dollar is something The Fed abhors (see March), which is ironic given as much hoopla as a "crashing" Dollar garners from pundits. But right now The Fed wants to stave off deflationary Dollar spikes more than anything else. And they think they can deal with any violent Dollar selloffs down the road...At least if you believe them.

Stock Market Recap 06/25/20 ... Weekend Overview and Analysi...