09Jul11:20 amEST

It Doesn't Count Unless Bears Get to Amazon

There is a certain humor in seeing just how blasé bulls have become about the dangers of so many parts of the market remaining weak. But how can you blame them with the sheer magnitude of the moves in names with monstrous market caps like AAPL AMZN MSFT, among other names like TSLA, which has effectively blasted many famed short-sellers into oblivion with it gaining roughly $1100 off the March lows?

With the broad market finally buckling just a bit more than usual this morning under the weight of small cap and financial weakness, virtually no one would be surprised if we close green anyway, especially on the Nasdaq.

Hence, with a new earnings season incoming bears still must discharge the burden of showing they can take down the true leaders of this market for more than a few hours.

Amazon is the likely prototype, especially in this new world since March. By now, we all know the seemingly unstoppable case for AMZN thriving even more than usual in the pandemic world, complete with rising crime rates and various other reason to simply stay at home and order what you need/want via the AMZN website or app.

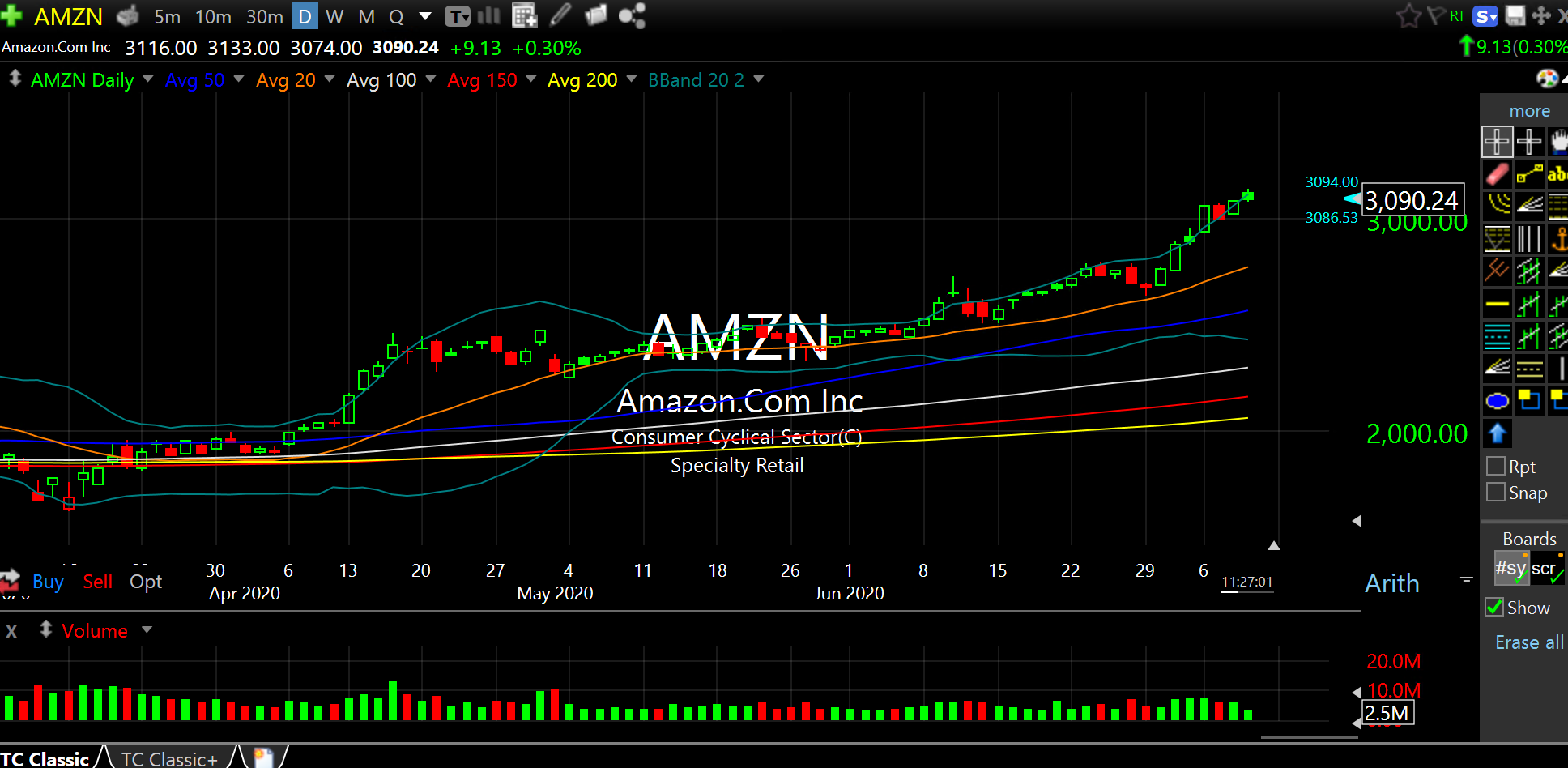

On the updated AMZN daily chart, below, the main takeaway is simply that the stock has been on a legendary tear. To keep things simple, unless and until bears can reverse the dominant leader of this cycle and market down below at least $2700 (with $3000 being a decent start) on heavy sell volume then it is tough to extrapolate too much or infer very much at all from a broad market standpoint regarding the weakness in the small caps, financials, casinos, airlines, cruise lines, etc..

Stock Market Recap 03/29/21 ... ...But I Might Be a Whole Ma...