06Aug11:04 amEST

Quick: Someone Tell the L.A. Mayor That Silver is Having a House Party

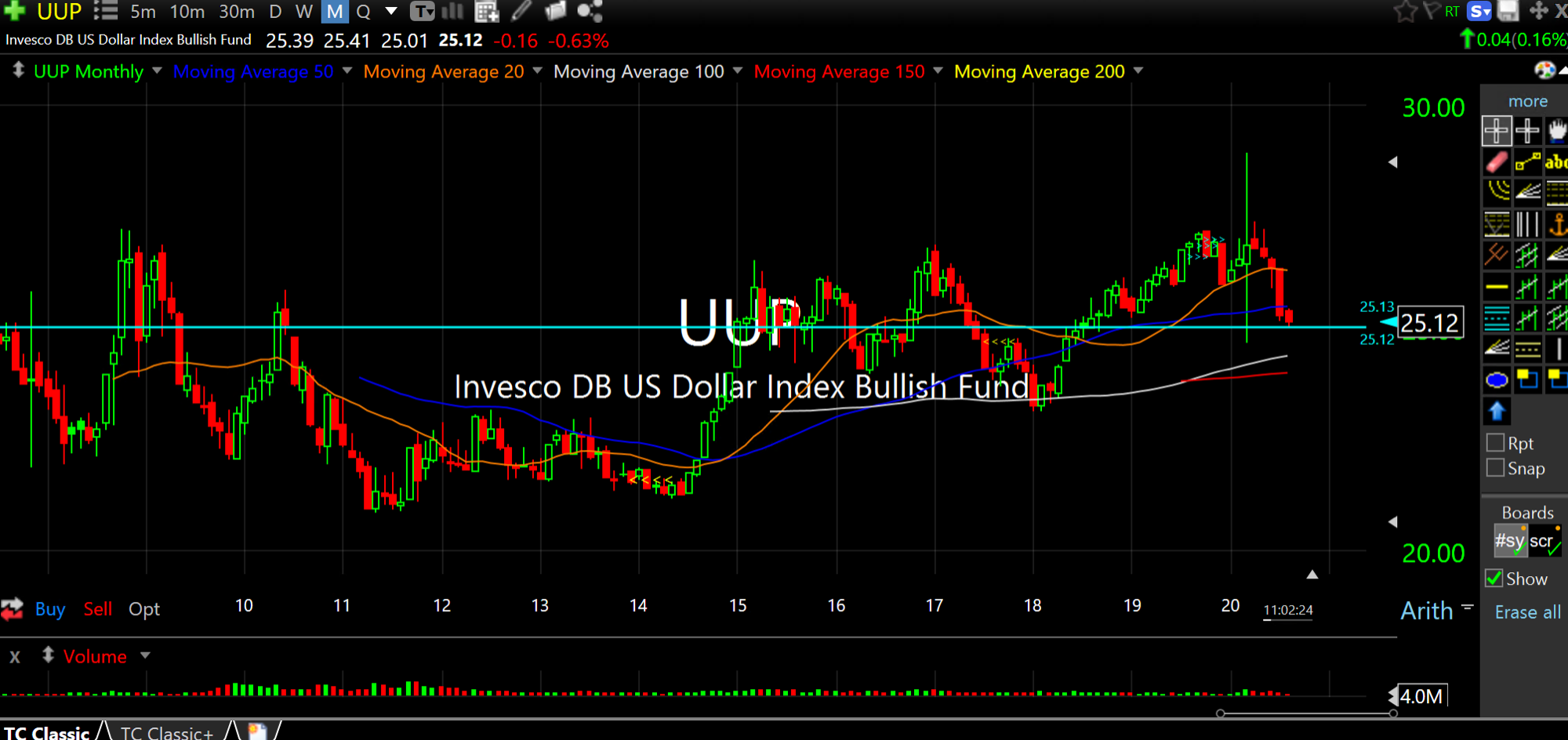

Dating back to 2007, the $25 level on the UUP ETF, seen below on its monthly timeframe, has been a notable price magnet in terms of how this U.S. Dollar currency ETF (which pits the Dollar versus a bunch of developed economies' currencies, in aggregate) tends to revert after violent price swings.

Thus, with increasing headlines and market player and pundits alike opining on the supposed imminent demise of the greenback, I am looking for some counter-trend reversion within the coming days and possibly weeks in the form of a Dollar bounce.

Note that the Dollar remains the world's reserve currency. And while the de-throning of said status may very well be inevitable, these sorts of events play out over the course of a century, or at least a few decade. The 21st century may very well wind up belonging to China or even Russia, for example, but keep in mind we ain't that far into the century, just yet.

As a result, the precious metals and their derivative miners are likely exhausted near-term, too. And equities, notably the Nasdaq monster leaders, ought to follow suit as the August/September seasonal forces kick in and some sobering reality about the state of the economy, Stimulus deal or no deal.

Silver has been on a 2010/2011-esque run, including this morning's 4-5% pop. My suspicious is that near-term traders going long SLV here amount to defiant house partiers in Los Angeles, which as we know now puts them at risk for a rather grotesque bathroom situation.

Tie Goes to the Money Runner... Stock Market Recap 08/06/20 ...