12Aug11:08 amEST

Extensive Testing

Various virus-related plays are getting crushed this morning, namely CODX INO NVAX, even the online schooling and curricula play, LRN.

Thus, with the major indices snapping back higher off yesterday's weakness, the issue is whether we should be onboard with the market's implication today that the economy is, in fact, on the cusp of a full-blown reopening. As it stands now, the jury is still out for a variety of reasons, especially with a litmus test like college football looking like a no-go for autumn. After all, if we do not have some of the lowest risk people in the country on the field for the annual season, it is tough to see how everything else will miraculously be back to normal anytime soon, too.

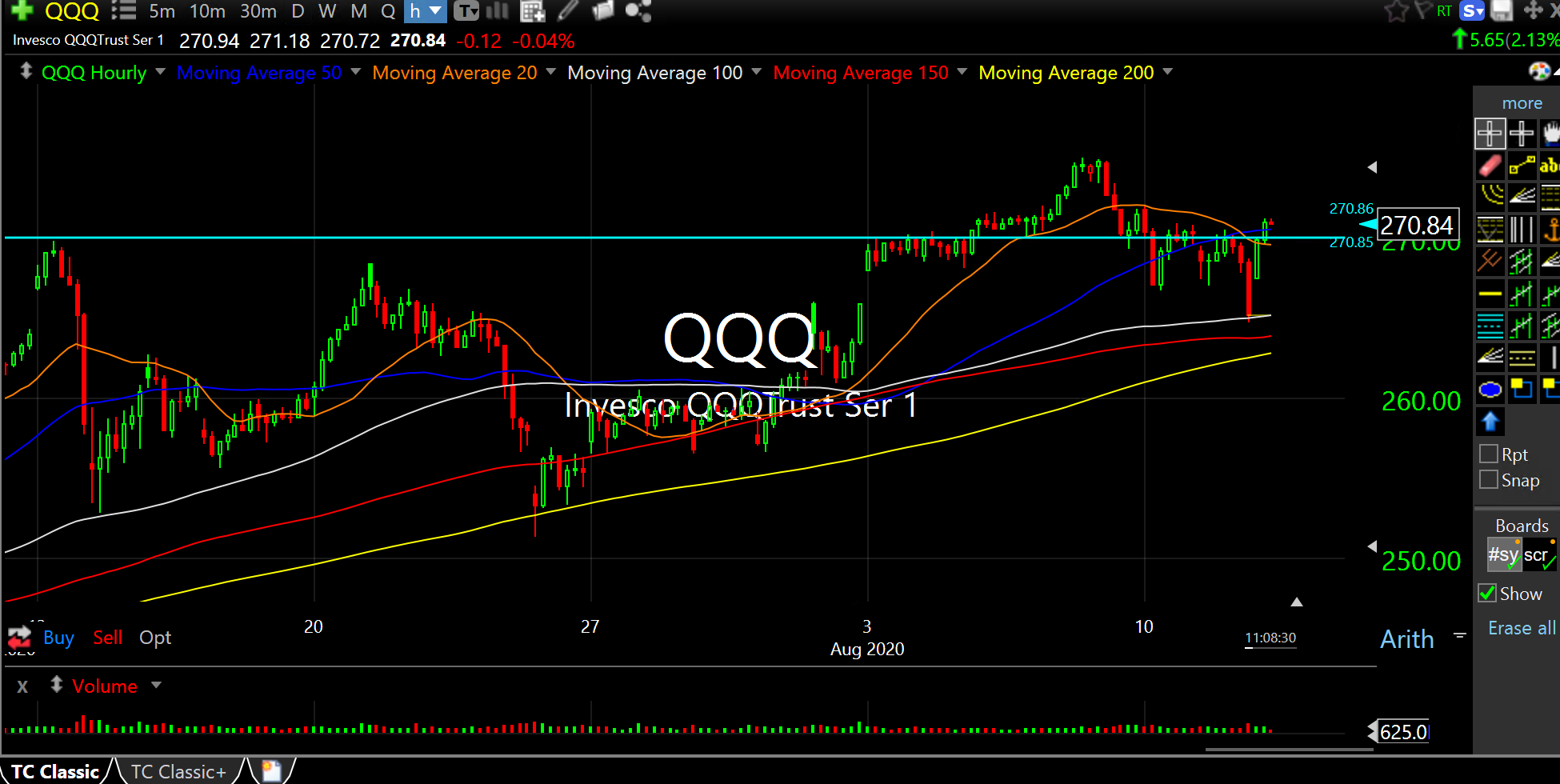

With this in mind, we continue to key off the $270 area on the QQQ ETF. Large cap tech is looking sharp again this morning after the last few days of soft action. But you can plainly see how pivotal $270 is on the hourly QQQ chart, below.

Indeed, all of this extensive testing of that level likely means we are close to a major directional move--I am closely watching the action here the rest of this week to see if the pop back over $270 holds.

U-V-X-Y: You Ain't Got No Al... Stock Market Recap 08/12/20 ...