13Aug11:30 amEST

Epic Summer Drift Upstream

Large cap tech continue to dominate again this morning, as the seemingly endless drift upstream in the QQQ ETF galvanizes bulls in names like AAPL AMZN FB TSLA, even SPCE after its recent pullback. While the move higher in rates (read: lower TLT) this week is likely to have ramifications going forward if it persists, the U.S. Dollar dipping red here is likely enough to keep equity bears at bay, for now.

Simply put, large cap tech dip-buyers have enjoyed such stunning yet continual success since the March lows that it is highly unlikely they will give up until they see, 1) Diminishing returns after said purchases, and 2) Subsequent hammering in the form of sharply lower equity prices). You might argue we are in the stages of seeing diminishing returns right now. But bulls will not relinquish their reigns until the second element is fulfilled.

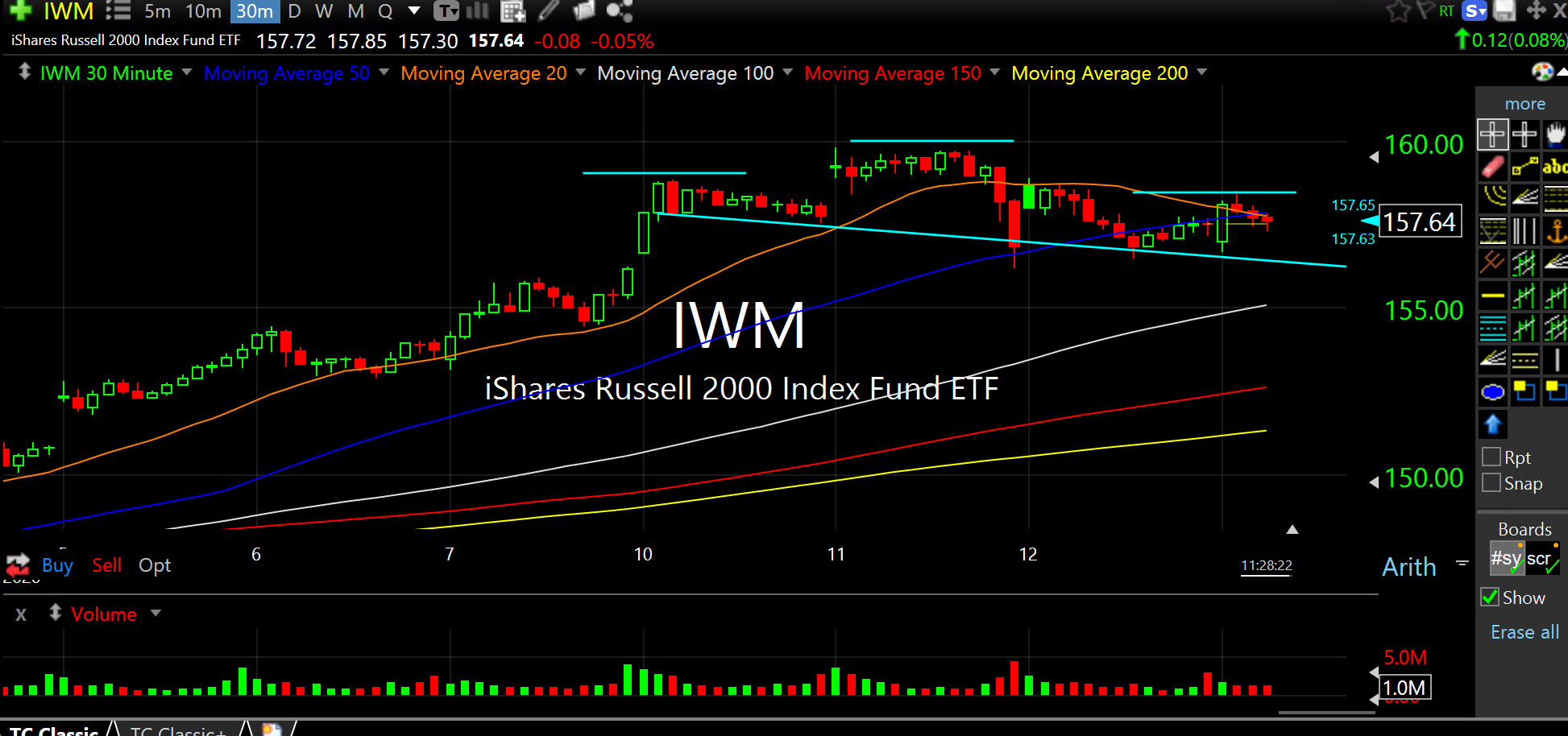

In the meantime, I am on the lookout for other changes in character besides rates. Small caps, for example, may be close to completing a 30-minute chart bearish head and shoulders top, seen below on the IWM ETF--If the selling picks up below $156 there may be something to it.

Also note continued strength in consumer staple stocks in XLP. The extended nature of various economic and life restrictions across the country could tighten back up again once some cold weather rolls in this autumn, meaning more time at home and more increasingly scarce household funds allocated towards groceries and other necessities.